Federal Reserve is still on track for March tapering

Financial markets are navigating a period of cyclical softness while assessing the pace for U.S. monetary policy normalization. After a volatility pick-up in January, U.S. equities have rebounded off their recent lows with some divergence year to date between indices i.e. S&P 500 -0.6%, Dow -2.9% and NASDAQ +1.8% YTD. Soft U.S. economic data and emerging market concerns have kept the 10 Year U.S. Treasury yield at 2.7%. From our investment perspective, we continue to favor a balanced portfolio of fixed income (non-agency MBS) and equity instruments (common equities and select preferred shares, REITS and MLPs). Thus, we favor a mix of income generating instruments and large-cap equities with healthy balance sheet and earnings profiles. At the sector level we favor cash rich sectors such as technology, healthcare and late-cycle industrials. Moreover, with tighter global oil/gas inventories, we remain constructive on the energy sector. As the Federal Reserve normalizes its monetary policy (QE) in 2014, we seek to be opportunistic in increasing our risk exposures at favorable entry points.

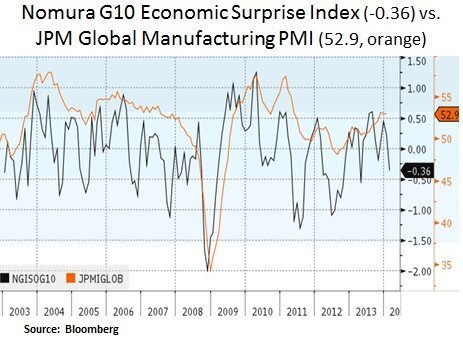

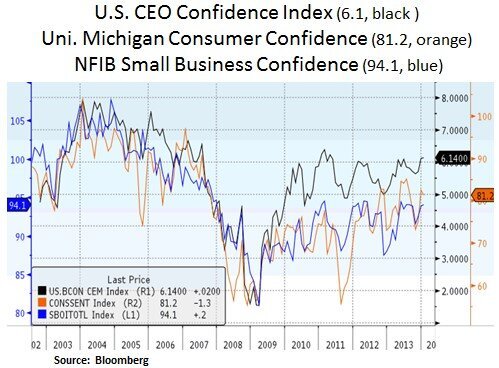

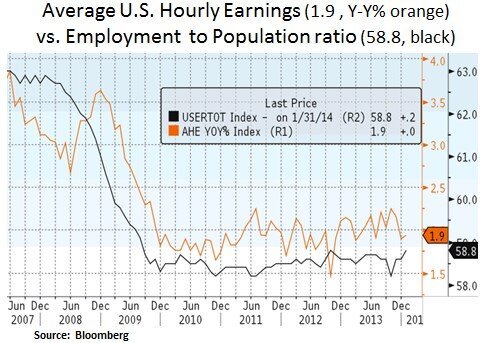

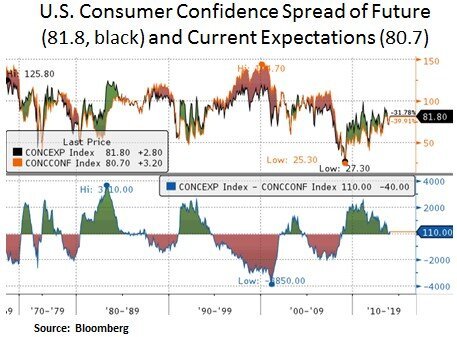

Recent global economic data have been underwhelming. In the U.S., housing, auto and manufacturing data points have been weaker than expected. In our view, the cyclical weakness can be attributed to inclement weather conditions and some unevenness in consumer spending. A soft labor market in December/January and unemployment benefit expirations (1.3 million) in December are contributing factors. Looking ahead, current confidence indicators do not point to a sustained downdraft in the economy. Most likely, there will be a cyclical rebound after the Q1 2014 headwinds abate. In our view, fiscal headwinds for the rest of the year are fairly subdued and both the corporate and household balance sheets are in a healthier shape. Thus, we could see some corporate and household pent-up demand being released in the coming quarters.

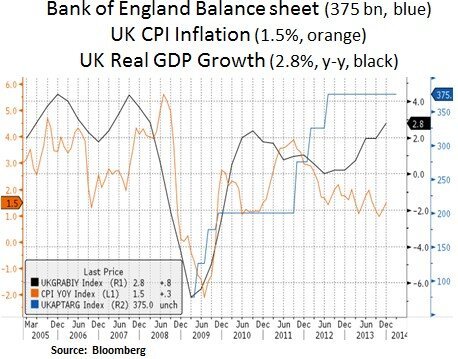

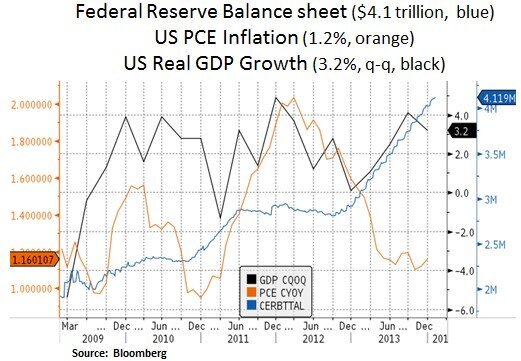

In terms of the Federal Reserve’s policy course, the Fed is likely to see through the current near-term cyclical/ consumer weakness; especially in light of the balance sheet repair at both the corporate and household level. As we discussed in past articles, we have been skeptical with regard to the actual effectiveness of quantitative easing at this stage in the business cycle. As we can see below, despite abundant liquidity in the financial system, the velocity of money is at multi-decade lows i.e. money is not being transacted fast enough. Moreover, the Fed’s key inflation metric (PCE) is also at very low historical levels. However, as demand for credit gradually recovers, there is a long-term inflation risk for the Fed. Thus, the Fed has the delicate task of balancing near-term economic growth and long-term inflation expectations. Barring an external economic shock, we expect the Fed to continue to reduce its asset purchases throughout 2014. Ongoing asset purchase tapering will likely cause further volatility episodes in emerging markets. Additional capital outflows from emerging market asset classes may likely be beneficial for both U.S. Treasuries and high quality quasi-fixed income instruments e.g. preferred shares, REITS, MLPs and utility stocks.

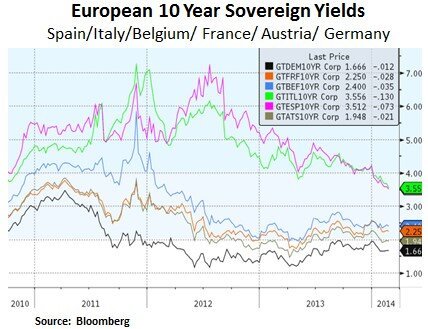

Lastly, market expectations are on the rise with regard to further liquidity measures by the ECB. As the European banking system delivers, this has led to a contraction of the ECB’s own balance sheet. With credit creation in check and Eurozone inflation at 0.7%, the ECB is facing increasing pressure to act on potential deflation risks. The Eurozone sovereign debt markets may already anticipate meaningful ECB action. Perhaps the ECB is seeing the relative ineffectiveness the U.S. and U.K. quantitative easing programs have had on inflation measures. Moreover, a recent ECB survey of professional forecasters supports the ECB’s own views that inflation will reach 1.1% in 2014 and 1.4% in 2015. Thus, there may be some disappointment if the ECB does not engage in an asset purchase program.

In conclusion, we continue to favor a balanced portfolio of fixed income and equity instruments with healthy cash generation and attractive valuation profiles. As global growth and liquidity measures fluctuate, we seek to add quality assets to our portfolios with exposure to secular growth themes e.g. enterprise I.T. spending and software, global pharmaceuticals and leading oil service names exposed to oil/gas shale exploration.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.