Is the European recovery sustainable?

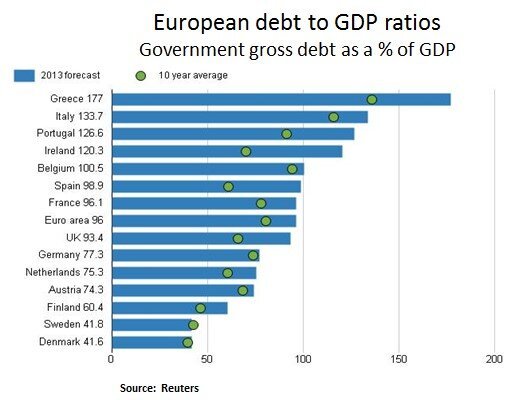

The Euro area is turning the corner from recession to a modest recovery, driven by exports and diminishing fiscal drag. The Eurozone is expected to grow its GDP by 1.1% in 2014 and 2015. From a structural perspective, we are observing continued progress by the peripheral economies in their quest to reduce fiscal and current account imbalances. Moreover, since the summer of 2012, the banking system is experiencing an improvement in funding conditions. We attribute this to the meaningful decline in sovereign debt yields across the Eurozone, especially for the large stressed economies of Spain and Italy. We also highlight the large inflow of foreign capital into the Eurozone e.g. the MFI net external asset position increased by 360bn EUR in 2013. The above backdrop is pointing to stabilization in the Eurozone‘s sovereign debt/GDP at 93% for 2014 and its unemployment rate at 12%. Our base case scenario is for a prolonged low growth environment as both sovereign and private sector debt deleveraging still has a long road ahead. Lastly, given the Eurozone’s high export exposure to emerging markets we see some growth headwinds and some disinflation creeping into the Eurozone area via low import prices. Thus, this soft growth and subdued inflation backdrop may require further monetary accommodation by the ECB. From an investment perspective, in the medium-term, a globally contained inflation environment bodes well for interest rate sensitive and high income generating securities.

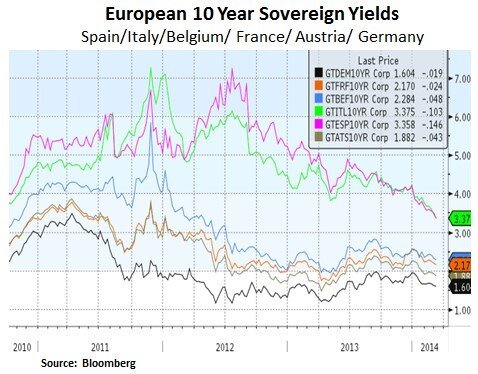

The Eurozone has been experiencing a modest recovery driven by German led export growth and some improvement in the Eurozone’s domestic demand. At the sovereign debt level we highlight the drastic improvement in funding conditions for stressed countries such as Ireland, Portugal and Greece. For example, their 10 year sovereign bonds are trading at 3%, 3.7% and 6.5% yields respectively. Ireland has exited its bailout program and Portugal is expected to exit its own by April. Perhaps more critically, Italian and Spanish yields are making new lows at 3.4%. This is taking place despite their debt/GDP levels increasing to 99% (Spain) and 133% (Italy). Without more meaningful structural reforms and improvement in competitiveness, we expect the market to test the sustainability of these borrowings costs; particularly for Italy that has been facing insufficient growth.

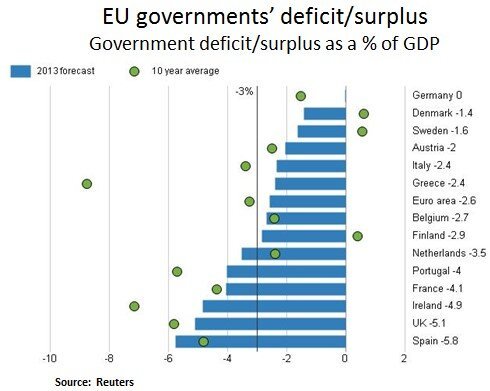

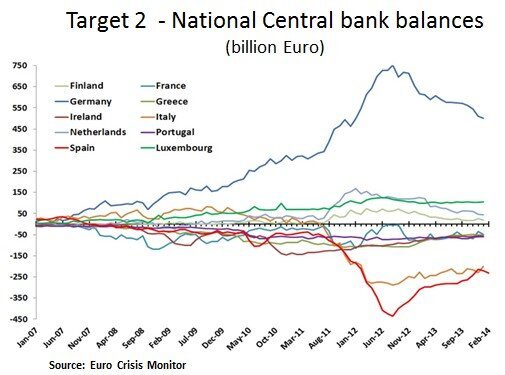

Following a period of austerity fatigue in 2012-2013, the outlook for the Eurozone’s fiscal impact is more neutral for 2014. As we can see below, the broad euro area budget deficit balance has improved and remains below 3%. We also highlight the relative stability in central bank money mobility within the euro area. For example, we see less inflows in Germany and less outflows out of Spain. This is a positive with regard to the financial fragmentation challenge that the ECB has been facing. As domestic banks gradually repair their balance sheets, we expect the ECB’s transmission mechanism of its monetary policy to improve.

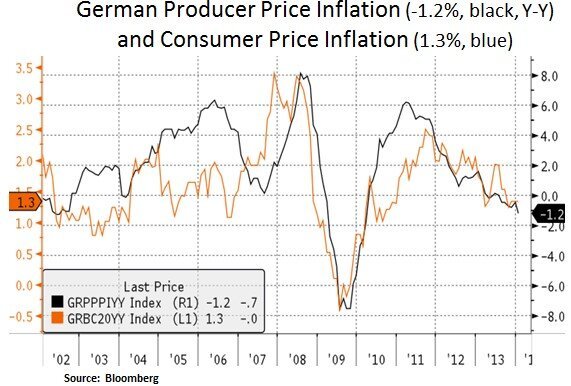

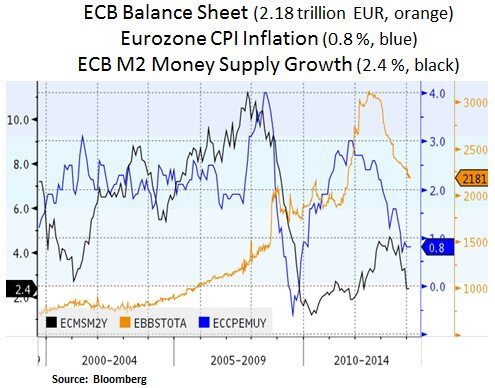

Given the above backdrop, the market’s focus has shifted away from sovereign crises and various types of bailouts to deflation concerns. The market is now focused on the persistent disinflationary trend. To a certain degree, low inflation is attributed to the Euro currency strength and the range bound price action in energy and commodities. Moreover, as a result of internal devaluation (high unemployment), labor costs remain subdued. The Eurozone is also importing cheaper goods from emerging markets whose currencies have been weak. Lastly, despite German unemployment rate hitting a 20 year low its labor costs remain low with no skilled labor shortages. A proposed introduction of a German minimum wage of 8.50 euro in 2015 may give wage inflation a small lift.

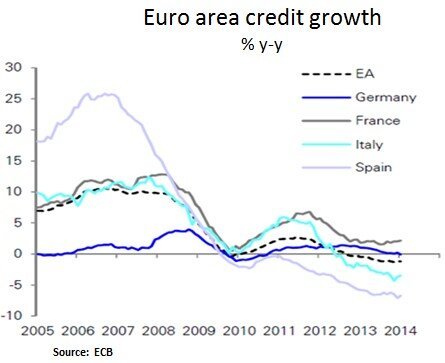

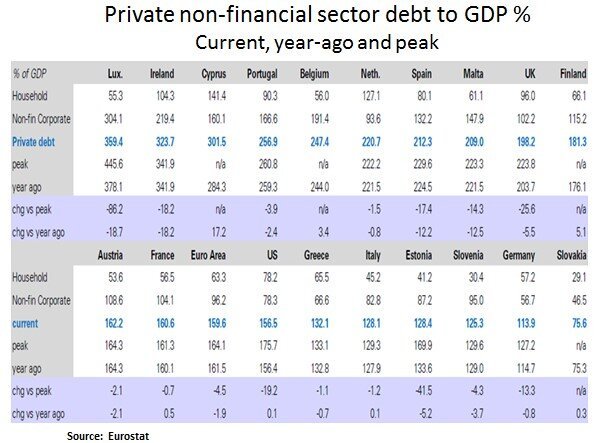

As broad debt deleveraging forces are still in force, credit growth remains quite restrained. Part of the reason is balance sheet repair by domestic banks and the nature of lending in Europe i.e. ~2/3 of corporate lending takes place via bank loan creation. The corporate debt market in Europe is smaller than the U.S. Moreover, there has been increased reliance of bank liquidity on short-term funding. This is a constraint when it comes to banks extending credit for a long horizon. Non-financial corporate credit creation has been running at -2.9% y/y. Spanish and Irish non-financial corporations in particular have led the recent private sector deleveraging; partly via asset write-downs. The ECB has identified ongoing deleveraging pressures to be most significant in Ireland, Spain, the Netherlands and Portugal.

As we can see below, private sector debt deleveraging still has a long road. According to a Mckinsey report, following periods of excess leverage, private debt leverage can be expected to be reduced by 40-55% over a period of 6-7 years. Thus, as demand for private sector credit remains low, fiscal and monetary policies have to fill in the gap in order to stimulate investments and support asset prices e.g. in the housing sector.

Lastly, emerging markets remain both an opportunity and a risk for European corporations. Over the long-term, emerging markets can be a source of opportunity as the EM middle classes experience income growth and take on more household credit. In the medium-term, emerging market economies such as Brazil, India, Russia and China are facing structural challenges and higher credit costs. Thus, with emerging markets accounting for ~50% of global growth and 33% of European corporate revenue, we see some headwinds to the Eurozone’s and Germany’s export growth.

In conclusion, our view of the European recovery remains balanced. Reform implementation is underway but not yet complete. Our base case scenario is for an elongated period of low growth and inflation with some periodic headwinds from both internal and external sources. If the disinflationary backdrop persists, especially in Germany, we may see some further monetary measures by the ECB. From an investment perspective, a globally subdued inflationary backdrop bodes well for interest rate sensitive and income generating financial assets. In equities, as productivity gains and investment spending have lagged in Europe, we would highlight the technology sector as a beneficiary of a rebound in European enterprise spending.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.