Emerging Markets facing global capital repositioning

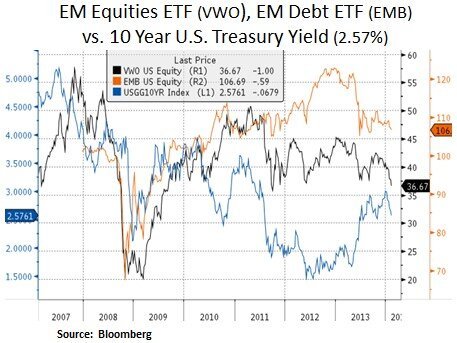

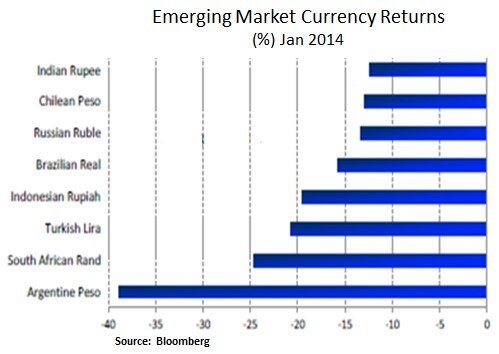

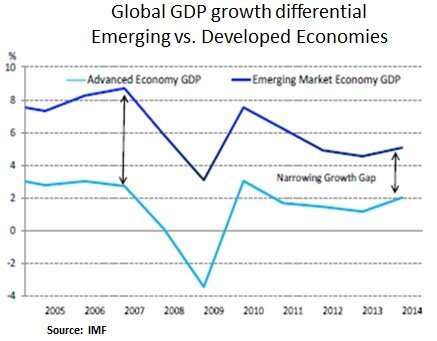

Emerging Markets (EMs) entered 2014 accompanied by elevated foreign exchange volatility and capital outflows ($12bn YTD). Weak currencies in vulnerable EMs prompted a number of EM Central Banks (e.g. Turkey, India, Brazil, South Africa) to raise short-term interest rates; in an attempt to stem domestic inflation and foreign capital outflows. In our view, EMs are facing global capital repositioning and risk premium re-pricing due to a winding down of global liquidity measures, a soft global trade backdrop and a slowing Chinese economy. The prospect of rising real interest rates in developed market economies leaves EM Central Bankers in a catch-up mode i.e. they need to raise their own domestic real rates in order to compete for foreign capital. In many EMs real interest rates are still negative. This re-pricing of negative real rates is forcing global carry trades to de-lever and unwind. Thus, a rising EM cost of capital and the ongoing tapering of the Fed’s quantitative easing (QE) program leave EM asset prices prone to tightening financial conditions and volatility episodes. From our investment perspective, we have been more optimistic on U.S. real rates staying contained and hence we have been tilting our portfolios toward income oriented securities such as preferred shares, REITS, MLPs and utility stocks. In U.S. equities, we have been reducing opportunistically our cyclical exposure. The flight to safety away from EMs and the recent pullback in U.S. equities (-5% YTD, S&P 500) have caused the 10 Year U.S. Treasury Yield to decline to 2.6% from 3.0% at the beginning of January.

Within EMs we expect the market to differentiate between economies which have been relatively ahead in their current account adjustment efforts and in their interest rate hiking cycles. Countries such as India will likely fare better than other EMs that exhibit high idiosyncratic risk i.e. elevated political risk, high current account deficits and over-reliance on short-term external financing e.g. Ukraine, Argentina, Turkey, and South Africa. In Brazil’s case, despite sticky inflation and insufficient fiscal reforms, we take solace from its sizable FX reserves ($376bn USD) and ongoing interest rate hikes. In Indonesia, its fiscal and monetary policy framework has proved responsive to the change in economic conditions. In Turkey’s case, despite sizable rate hikes in the past week (e.g. overnight lending rate rising from 7.75% to 12%); political risk is still the main source of instability. Moreover, Turkey has experienced a material increase in its credit to GDP in recent years.

A common issue challenging EMs is insufficient export growth despite currency depreciation in 2013. Currently, we are observing a divergence between global growth and global trade. In our view, this is due to Europe/China/U.S. imports flat-lining. Thus, we expect further currency depreciation for countries that are more dependent on export growth. For example, in South Africa’s case, despite material currency depreciation from 6.5 ZAR/USD in April 2011 to today’s 11.2, its current account has seen very little improvement.

Banking regulation is another EM topic that is not garnering enough financial media attention. Under the Basel 3 rules, capital and liquidity standards (LCR – liquidity coverage ratio) are requiring EM exposed banks to hold assets that are easy to sell in the event of a crisis. In developing economies, high quality liquid paper is not in ample supply. It is worth noting that despite Central Bank liquidity in U.S. and Europe, official money supply (M2) measures are declining. European banks in particular continue to deleverage their sizable balance sheets and they have been repaying their LTRO loans back to the ECB ahead of this year’s Asset Quality Review (AQR). European banks have loaned in excess of $3 trillion to emerging markets. As a result of this deleveraging process and the Basel 3 regulations we see headwinds for external EM credit supply.

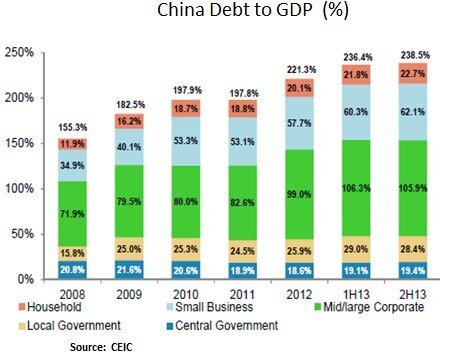

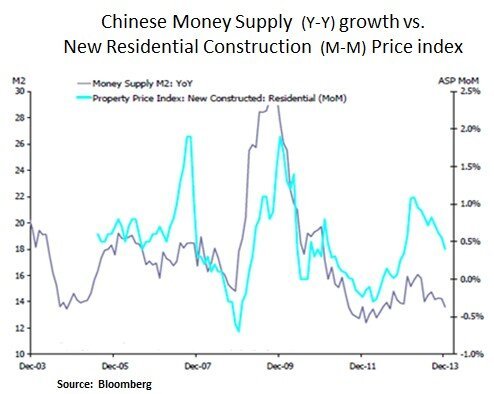

In Asia, healthier economies that have been big capital flow beneficiaries of the Fed’s quantitative easing (QE) program will likely experience weakness in their currencies e.g. Singapore, Malaysia and Taiwan. More importantly, China’s own credit and property market dynamics are also likely to have ripple effects across EMs; particularly those exposed to commodity exports e.g. South Africa. China faces risk stemming from a credit-fueled investment boom, with excessive borrowing by local governments, state-owned enterprises, and real-estate firms weakening the asset portfolios of banks and shadow banks. In our view, reforms to rebalance growth from high savings and fixed investment to private consumption are likely to be implemented slowly. As we can see below, China has experienced rapid corporate debt growth with high reliance on short-term funding. Re-pricing of underlying credit risk in China is already underway.

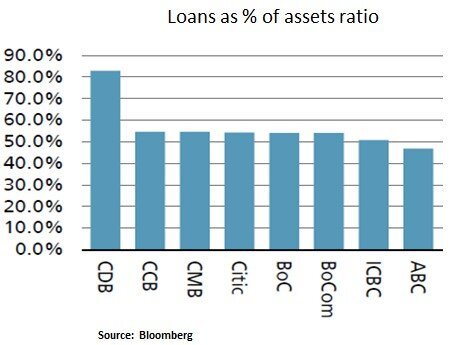

Amongst China’s most important financial institutions, as we can see above, we highlight the China Development Bank (CDB); its bond yields have been on the rise. This yield move has not been evident in previous liquidity squeezes. If it persists it could potentially be significant as CDB relies heavily on bond issuance for funds (it takes no deposits). CDB was set up to provide finance for higher risk, longer term infrastructure projects. CDB is the second biggest bond issuer in China behind the ministry of finance. As of YE 2013, CDB had $1.4 trillion in assets and it carries a high loan to asset ratio. Increased borrowing costs are likely to be passed to borrowers e.g. local governments.

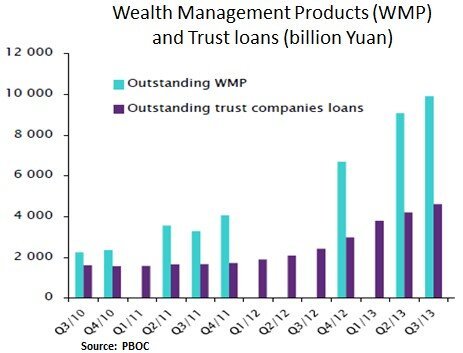

Lastly, as we highlighted in recent articles, beyond the boundaries of the traditional banking system, Chinese corporations have been securing high cost financing through the Chinese ‘shadow banking’ system. In the trust products market we see elevated loan rollover risk in 2014. Most recently, on Jan 27th, the China Credit Trust Company secured a restructuring deal for a distressed trust loan that backed the RMB 3bn No.1 trust product. Increased PBOC efforts to regulate the shadow banking system are likely to lead to less credit growth and property price dampening.

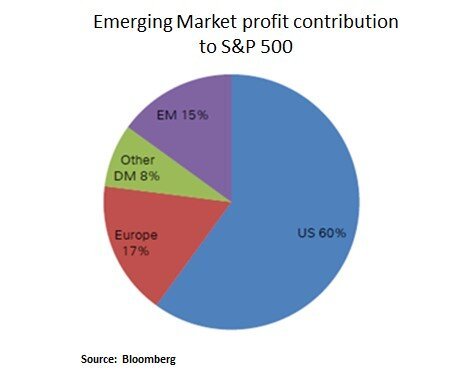

In conclusion, emerging markets are navigating a period of global capital repositioning and a transition to normalized growth. The Fed’s QE tapering and China’s slower growth prospects are likely to be headwinds in the medium-term. Over the long-term we are optimistic that the EM’s favorable demographic profiles, lower overall debt levels and a growth mix shift to domestic consumption will be pillars for sustainable growth. We seek to be nimble in adding quality U.S. multi-nationals exposed to secular EM growth opportunities e.g. in I.T., healthcare and consumer discretionary sectors.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.