Global economy is in a quest for sustainable growth

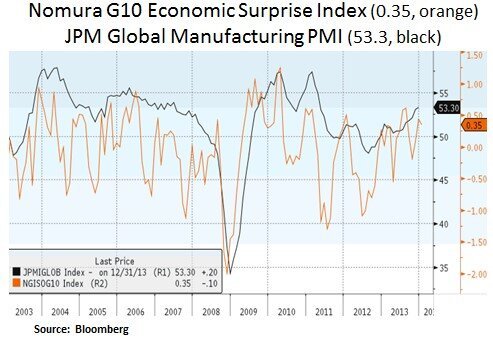

Investors and economic participants are entering 2014 with higher expectations for global growth. Consensus estimates point to a pickup in global growth from 2.4% to 3.1%. In the U.S., the market expects a GDP growth rate of ~2.7%; as CEOs and households have greater visibility over a more neutral fiscal policy and a gradual normalization of monetary policy. Europe is expected to exit its recessionary state as it continues its slow journey towards a more sustainable fiscal model and banking system. Emerging markets on the other hand are likely to continue their efforts for structural reforms as a way to reinvigorate their growth profiles. Further east, China and Japan are going to be key economies to monitor as any policy misstep or a growth disappointment may have negative ripple effects for global growth. From an investment perspective, an improved growth backdrop and subdued inflation are likely to be supportive for risk assets such as U.S. equities. Tactically however, with elevated investor expectations and asset prices, we maintain a selective investment stance with a sharp focus on bottom-up equity valuations. Moreover, as the Fed scales back its asset purchase program in 2014, we seek to opportunistically add exposure to interest rate sensitive securities e.g. utilities, MLPs and preferred shares.

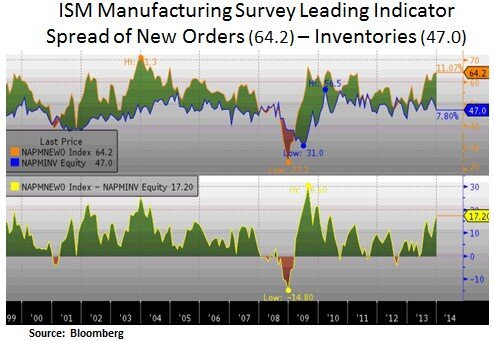

As U.S. public policy uncertainty is fading at the beginning of 2014, business and household confidence is on the rise. Recent labor, trade balance and manufacturing readings point to an accelerating U.S. economy. The Fed shares this optimism and as such it has embarked on a gradual normalization of its unconventional monetary program in 2014. As capital expenditures accelerate in 2014, we expect the technology, energy and industrials sectors to benefit. We highlight the technology sector as it has lagged the overall market in 2013 and it is likely to be a focal point for business investment, as CEOs seek to further improve productivity and protect profit margins.

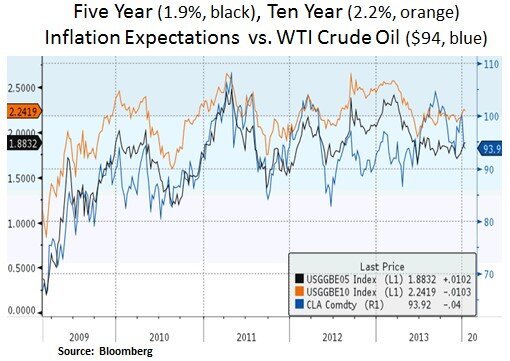

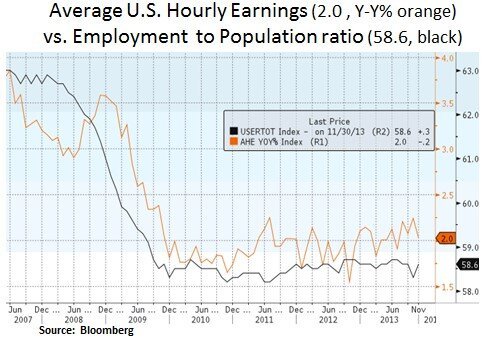

We view inflation expectations, labor conditions and U.S. housing as key variables which the Fed will scrutinize closely in 2014; as it switches gears in its policy normalization. With a more neutral fiscal outlook in the medium-term, the Fed is jumping on the opportunity to scale back its quantitative program while maintaining an easy forward rate guidance. As inflation is still low, the Fed is attempting to anchor the front end of the Treasury curve with its zero rate guidance. As growth improves, the Fed has an enormous challenge on its hands as it seeks to mop up excess reserves in the banking system. This matters with private loan demand showing signs of a pick-up, as households are at a fairly advanced stage in their balance sheet repair.

At over 20x statutory reserve levels, current excess reserves pose a potentially material inflation risk over the long-term. In addition, a more robust labor market could gradually contribute to labor cost pressures over time. Thus, the Fed has recently started testing other policy tools such as reverse repos as a tool to drain excess liquidity from the banking system. The Fed’s recent language seems to be downplaying the marginal benefit of its QE program, with emphasis now on the difficult part of exiting its unconventional program and on the potential risk for other unintended consequences e.g. asset price bubbles and fixed income issuance with too loose covenants. Therefore, the main risk for 2014 is how well the Fed executes its exit strategy while the real economy attempts to accelerate to higher levels.

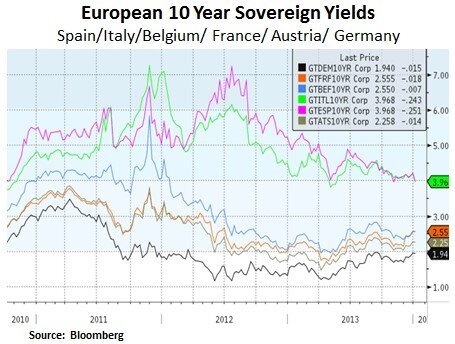

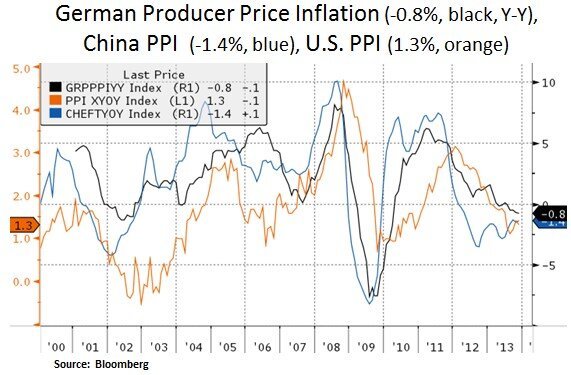

On the European front, we highlight the recent yield decline in peripheral sovereign debt. On the back of recent manufacturing traction, borrowing costs have declined for countries such as Spain (3.8% 10yr note), Italy (3.9%), Portugal (5.3%) and Greece (7.6%). Moreover, after recently exiting its bail-out program, Ireland has recently issued sovereign debt at 3.5% for their 10 year note. In our view, the sustainability of these yield levels may be tested throughout 2014. Yet, from a systemic point of view and as reforms continue, relative calm in peripheral debt markets is encouraging and from an earnings perspective U.S. multi-nationals stand to benefit from a slow but steady European recovery. With inflation being a lagging indicator, as growth picks up we should see some stabilization in European inflation.

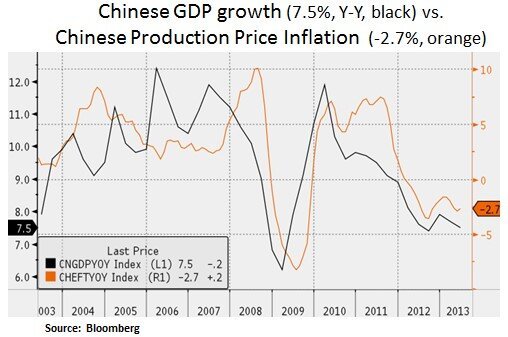

In Asia, China is a key economy to watch in 2014. China is still attempting to rein in credit excesses at the state and local level, as well as within the Chinese shadow banking system. China’s financial system was long dominated by banks, which traditionally accounted for more than 90% of all funding in the economy. But over the past 5 years, the rise of non-bank institutions, especially trust companies, has changed the complexion of Chinese finance, with banks now providing roughly 50% of all new funding in the economy. Therefore, China’s handling of its credit excesses and its transition towards consumer led growth will matter for 2014 and beyond. In our view, Chinese GDP growth will likely head towards 5% in the coming years. This will have further repercussions for emerging markets that are more tied to Chinese growth and commodity exports. From our investment perspective, disinflationary trends out of Asia may keep U.S. inflation and rate hike fears in check. Thus, with a low inflation backdrop, income oriented securities will likely stay in demand.

In conclusion, as we enter 2014 we should see the growth pendulum swing towards developed markets and emerging market/Chinese economies will likely continue to adapt to lower growth rates comparing to the past decade. Moreover, as the Fed’s monetary policy normalizes, we seek to be opportunistic to capture value on any pick-up in volatility; especially in interest rate sensitive equity sectors and fixed income securities.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.