Trump Victory Reinvigorates U.S. Stocks

U.S. stocks’ capitalization rose by $1.62 trillion to a fresh record high on Wednesday, the best post-election day performance in history following Donald Trump’s decisive election win. Investors sent U.S. assets from stocks to the dollar surging on optimism that the new administration would bring lower taxes and less regulation. The Russell 2000 index of small cap stocks gained almost 6%, its best day in two years, as investors believe a shift away from globalization toward a focus on domestic companies will stoke growth. Furthermore, a Republican sweep of Congress, which is looking increasingly likely, would significantly ease the path for Trump to enact his policies. Goldman Sachs estimates that GOP House control could enable corporate tax reform, potentially reducing the tax rate from 21% to 15% and increasing EPS estimates by 4%.

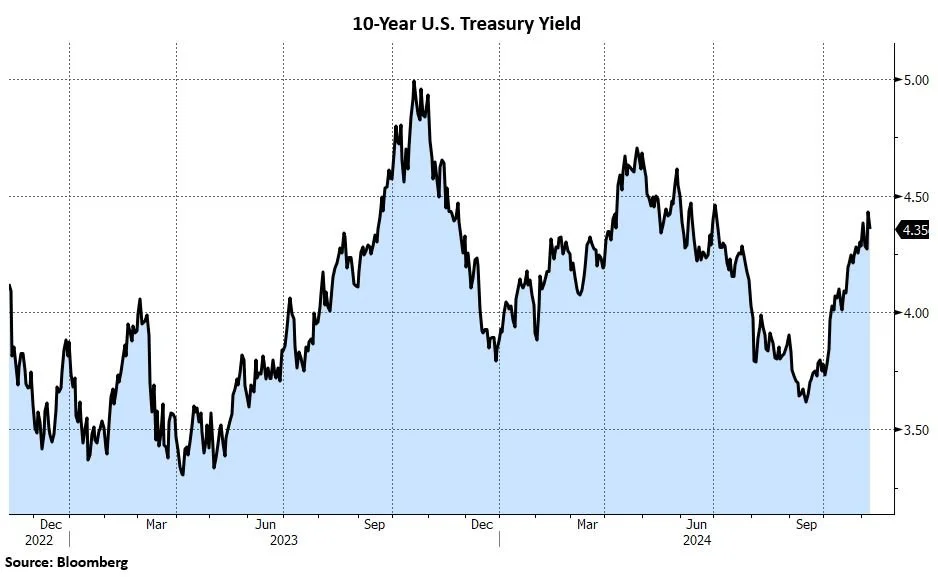

The U.S. Treasury market, however, did not celebrate President Trump’s return to the White House. Yields soared on the view that Trump’s agenda – more spending, low taxes, tariffs, limiting immigration – will fuel inflation. The 10-Year U.S. Treasury note touched 4.48% intraday Wednesday, a level not seen in roughly five months, before retreating. The overarching theme of reflation has returned to the fore as the new administration will bring higher economic expectations and inflation, along with a continuation of fiscal irresponsibility. Bets on a resurgence in U.S. inflation can be seen by the two-year inflation swap rate rising 20 basis points to 2.62%, its highest level since April.

Higher borrowing costs should be dangerous to stocks, and yet the S&P 500 continues to make new highs for several reasons. The U.S. economy is experiencing a structural tailwind in artificial intelligence, consumers and corporations locked in low-rate financing during the pandemic, and there has been a deluge of fiscal spending. The U.S. government will pay over $1.2 trillion in interest expense in 2024, and pays out more in interest than it spends on national defense. The current path is not sustainable, and at some point, the bond vigilantes (investors who seek to impose fiscal discipline of reckless governments by driving up borrowing costs) will be spurred into action. President Trump has promised to slash government spending in an effort to help pay for the tax cuts, but the feasibility of this remains to be seen.

Fed Chair Jerome Powell will have a difficult task as a second Trump term has stoked concerns over inflation. As expected, the Fed lowered rates by 0.25% yesterday, but Trump’s policies may change the trajectory and magnitude of cuts going forward. While Powell would not tip his hand on whether the Fed would likely cut rates in December, Wall Street economists have reduced their expectations of future Fed easing.

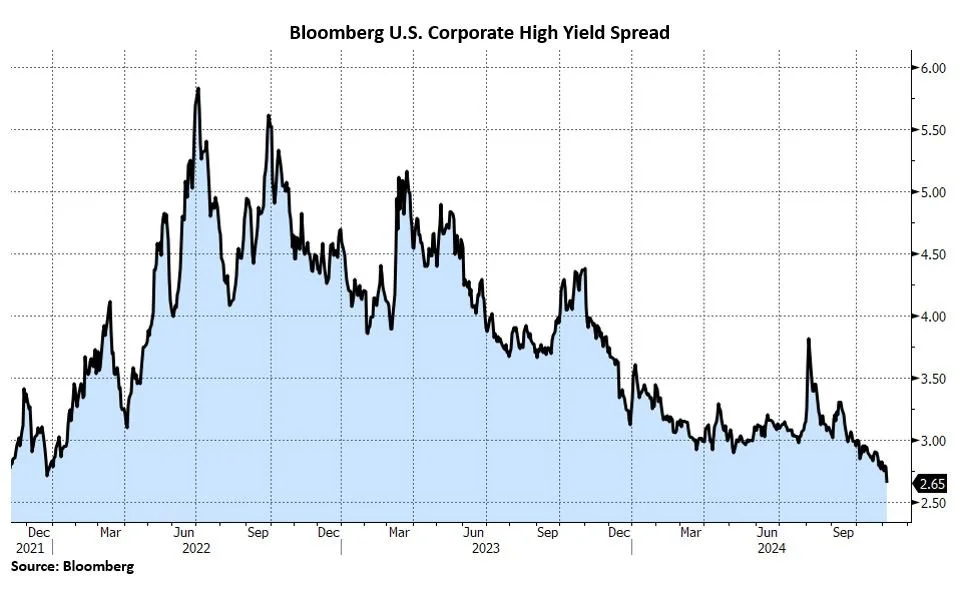

In credit, spreads have continued to tighten with junk bond spreads posting their largest decline in a month. The spread on the Bloomberg U.S. Corporate High Yield Index fell to 265 basis points, a new multi-year low. High yield bonds tend to have a higher correlation to equity markets, and should benefit the most from the likelihood of lower corporate taxes. The move in spreads in large part can be attributed to the combination of strong economic growth, robust technical demand for fixed income, and, most recently, the outcome of the election. We view the risk/reward in credit as unattractive at these levels. We continue to favor Agency mortgage-backed securities and believe that the rebound in mortgage rates and consequent decline in refinancing applications indicate a cyclical peak in prepayment speeds.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.