Strong Labor Report Provides Ammo for “No Landing” Narrative

U.S. equity markets have gained roughly two percentage points since the Federal Reserve announced that they were lowering the Federal Funds rate by 0.50% on September 18th. Fed Chair Jerome Powell said the central bank will lower interest rates “over time,” while emphasizing that the overall U.S. economy remains strong. “Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance,” Powell said in a speech in Nashville, Tennessee at the annual meeting of the National Association for Business Economics. “But we are not on any preset course,” he added, noting that policymakers will continue to be data dependent and will make decisions meeting by meeting.

The source of concern for the Fed in lowering the policy rate by 0.50% stemmed from the deterioration in the labor market. The unemployment rate had gone up, the hiring rate had fallen, and job openings dropped dramatically. Last week’s strong employment report for September however has created a significant recalibration in markets. The U.S. added 104,000 more jobs than expected, the prior month’s report was revised higher by 17,000 jobs, and the unemployment rate fell from 4.2% to 4.1%. The Fed’s narrative for more aggressive rate cuts was that inflation is heading to 2% and the labor market is weakening. Last week the ISM Non-Manufacturing PMI data posted its hottest reading since January 2023, and the Atlanta Fed GDP estimate for the third quarter stands at 3.1%. As a result, the “no landing” scenario- a situation where the U.S. economy continues to expand, inflation reignites, and the Federal Reserve has little room to reduce interest rates- has begun to gain traction again.

The bond market has reacted meaningfully to this shifting narrative. The 2s/10s curve-the difference in the yield between the U.S. 10-Year Treasury bond and the 2-Year U.S. Treasury note- briefly turned negative this morning, when just last month it turned positive after 565 consecutive sessions of inversion. Bonds yields are rising as investors emphatically reverse course on bets for future Fed rate reductions.

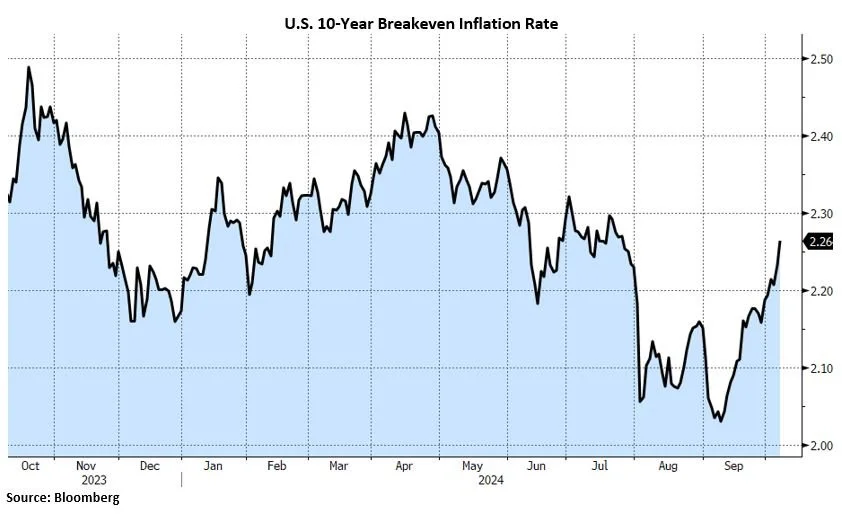

Meanwhile, inflation has made its way back into market conversation as the price of crude oil has surged with mounting tensions in the Middle East, and speculation that Israel may strike Iran’s oil infrastructure. The 10-year breakeven rate, a measure of bond traders’ inflation expectations, has risen to a 2-month high, rising from a multiyear low just last month.

Stocks now remain in a holding pattern as investors await this week’s key CPI data and the start of corporate earnings season. While the strong jobs report has eased concerns regarding a weakening labor market, data that points to re-accelerating price pressures will resurrect fears that a hot economy is at risk of overheating. Given this backdrop, we remain vigilant for any opportunities this shifting landscape may present.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.