More policy execution and an oil price decline are required

Risk assets, such as U.S. equities, have been supported since last fall by labor market improvement in the U.S. economy and by a material wave of global monetary accommodation. The ECB in particular spearheaded the policy easing by injecting 1 trillion Euros into the European banking system. At this juncture, the market is likely to focus on four key drivers for the rest of the year - a. the impact of elevated oil prices on inflation, b. Chinese and other global monetary accommodation, c. European growth under austerity and d. how U.S. leaders will deal with the projected 2013 fiscal drag.

China has been one of the key drivers of the global growth recovery since 2009. Infrastructure and property spending have been important engines of growth, along with net exports. China is now trying to rebalance its growth to a more consumer driven economy, with a 2011-15 GDP growth target of 7%. This big transition will likely not come easy given the disparity between public and private income. Thus, in the medium-term, China needs to implement a more aggressive monetary accommodation in order to cushion its own economic transition and the economic fallout from the European economy. Chinese policymakers have indicated an expansion in the M2 money supply to 14%, via a series of reductions in the required reserve ratio for banks. Inflation and oil prices though are likely to be important catalysts to this accommodation. As we can see below, CPI inflation has recently declined due to food prices but Brent crude oil remains a key risk. Inflation is a lagging indicator and the CPI indicator may tick up again as the oil price remains elevated. The recovering Chinese yield curve and Shanghai equity market may have sniffed out an imminent monetary accommodation but the oil price is likely to be an issue for subsequent easing steps.

A material monetary accommodation by China would certainly be a boost to the global economy. In conjunction with a stable credit environment in the core European economies, there may be a window for an upward turn in global growth. This potential accommodation would be a boost to the global manufacturing cycle and especially to commodity exposed economies such as Brazil and Australia.

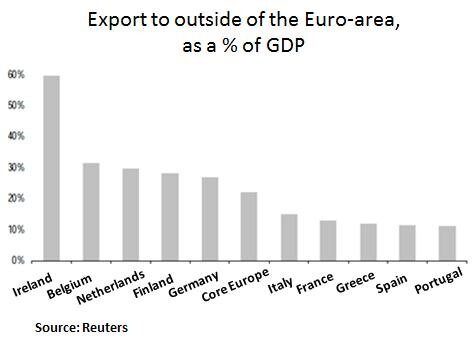

On the Eurozone front, the ECB still has more room to act. Apart from expanding its balance sheet, the ECB needs to devalue the Euro materially in order to offset the strict fiscal plan that European leaders have adopted. European oil prices may be very elevated but given the slack in the European economy and its labor market the ECB will likely continue its more aggressive stance in order to support especially the large economies of Spain and Italy, which are lagging in terms of export growth potential. The Eurozone debt crisis at its core is really an internal trade imbalance problem and as such the ‘crisis’ is the competitiveness and trade gap. Therefore, as austerity will not close this gap, the ECB has to continue in its aggressive monetary path.

As we can see below, the ECB’s LTRO program has led to a dramatic turn in the Italian yield curve, which indicates a less stressed economic outlook. Moreover, European equity markets such as the German DAX have recovered due to the reduction in the risk premium. We point however to the still depressed German Bund yields. This highlights the flow of the ECB’s liquidity into the sovereign debt markets. One of the key issues that has to be resolved is the June deadline for the 9% core Tier 1 requirement for European banks. Bank deleveraging may weigh on credit growth, as banks need to shed risk assets. The recent ECB liquidity has flowed into sovereign bonds, as they are not considered a ‘risk asset’ with regards to their capital requirements. Therefore, some relaxation of this capital requirement will likely be good for European growth and a better growth profile may then be reflected in the German Bunds, thus recoupling with equities.

On the U.S. front, despite an improvement in the domestic oil production the elevated Brent oil price is still an issue as it directly impacts the U.S. trade balance. As we can see below, inflation expectations in the Treasury market have been on the rise recently due to elevated oil and gasoline prices. In addition, unit labor costs have recently been on the rise. Therefore, despite a lot of slack in the U.S. labor market, elevated headline inflation due to energy prices may be an obstacle to unsterilized monetary easing by the Federal Reserve.

On the U.S. front, the ECRI leading economic index has been recovering. This indicates a moderate growth rate in the U.S. economy. A combination of further global monetary accommodation will likely be supportive to risk assets such as U.S. equities. As we can see below, positive corporate earnings surprises have been on the decline in Q4 2011. A recovering credit environment in Europe and a recovering labor market in the U.S. may lead to upward earnings revisions. Moving towards year end, the market needs to see some concrete U.S. policy plans with regards to the scheduled Jan 2013 fiscal drag (~3%). Thus policy execution will be a key factor for the sustainability of the risk rally and the currently subdued short-term volatility. The volatility futures curve indicates some concern towards year end.

In conclusion, we appreciate the importance of global policy execution and its impact on risk assets. In addition, we recognize that oil prices can pose a risk to global growth. Thus, at this juncture, we continue to focus on a balanced portfolio of income generating instruments and attractively valued securities that offer a margin of safety.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.