Improving market backdrop remains challenged by policy execution

Risk assets, such as U.S. equities, have continued their strong start to the year (+6.1% YTD) on the back of reduced tail risks and expectations for a rebound in global growth. 2013 has also seen a noticeable acceleration in M&A (e.g. Heinz takeover by Berkshire) and other corporate deals (e.g. Dell LBO). Moreover, after increasing dividend payouts to shareholders in 2012, the corporate sector continues to be a notable buyer of equities in an attempt to enhance shareholder returns. Looking ahead, the path of risk assets will depend on delicate execution by policymakers across both sides of the Atlantic i.e. balancing fiscal consolidation with the pace of underlying economic growth. Moreover, as inflation expectations remain in check, we expect monetary policy to remain very accommodative. Thus, we expect demand for low duration income generating instruments such as MBS to continue. On the equity side, at this stage of the business cycle, we continue to favor late-cycle sector and secular growth themes such as healthcare, energy infrastructure and global industrials.

The low equity volatility and low intra-stock correlation features have rendered the market with more opportunities for individual security selection. Unlike previous years, thus far this year we have witnessed less ‘risk-on’/’risk-off’ asset moves. To a certain degree, risk assets have benefited from a gradually improving macro backdrop in Europe as indicated below by the European economic surprise index. In addition, we have started to see less demand for safe haven assets such as gold and treasury inflation protected securities. Historically, as real rates start rising gold tends to underperform.

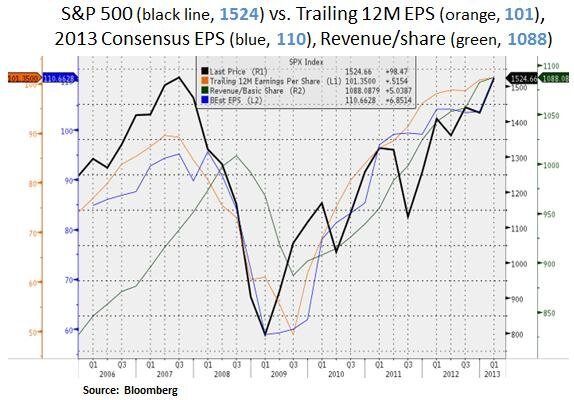

With regard to equity fundamentals, despite numerous headwinds, Q4 of 2012 witnessed higher than expected earnings and revenue per share for S&P 500 constituents. We note however that profit margins came under some pressure. From a Return on Equity (ROE) perspective, we expect some financial re-leveraging by corporations to add to ROE as an offset to profit margin softness. From a performance point of view, the S&P 500 index has broadly tracked the trailing and expected EPS trajectories. At this stage of the business and profit cycle we expect equity earnings growth to converge towards global economic growth. We continue to be opportunistic in seeking favorable risk-reward opportunities and we favor late-cycle/secular growth themes e.g. equipment & software and pharmaceuticals. We favor large-cap corporations with solid balance sheets and ample free cash flow yields that can facilitate dividend growth and share buybacks.

At this stage of the business cycle, global economic growth is a key determinant for profit growth. Global growth expectations have been improving as of late and there are some leading indicators that point to a U.S. growth rebound in Q1 of 2013. For instance, we see corporate credit spreads being even tighter and initial jobless claims are showing some encouraging signals for the job market. Lastly, ISM manufacturing new orders are in expansion territory (>50). Therefore, as long as the macro backdrop is improving, we see merit for continued exposure to U.S. equities.

To be sure, we expect U.S. growth to remain in low gear as fiscal headwinds are likely to offset some positive economic momentum out U.S. housing and the U.S. energy sector. Fiscal consolidation is likely to be an ongoing debate in Washington, and spring is likely to be a busy time for fiscal resolutions and compromises. Key dates are March 1st ($85bn sequester), March 27th (2013 Federal Budget), April 15th (2014 Federal budget…) and May 19th (Debt ceiling expiration). Given the slow pace of economic growth, it is plausible that some fiscal cuts may be reconfigured or postponed. Such a scenario would give risk assets some relief in the medium-term. Having said that, long-term sustainability of U.S. fiscal and entitlement policies is important and long-term visibility would give businesses and households more confidence to engage in large ticket investments e.g. housing, autos and I.T. equipment. Therefore, we look forward to balanced solutions.

Unlike the low volatility in U.S. and European equities, FX markets have witnessed big swings. The Japanese yen has been weakening notably on more aggressive monetary posturing. On the other hand, the Euro has been appreciating vs. the USD, GBP and the JPY, as the ECB has allowed for some shrinkage in the size of its balance sheet. FX volatility or ‘currency wars’ is certainly a space to watch. Historically, currency skirmishes have led to trade protectionism. Given the challenges Europe is facing we expect the ECB to keep a lid to outsized Euro appreciation. From a macro risk point of view, we continue to monitor the economic health and politics in key economies such as Spain, Italy and France.

On the energy front, we note that crude oil and U.S. gasoline prices have been elevated as of late. Elevated prices pose a risk for the global and U.S. consumer but we expect increased oil supply and seasonal gasoline switching to alleviate these consumer headwinds.

On a more positive note, we are encouraged by the ongoing momentum in U.S. housing and the U.S. energy sector. As credit conditions improve even further, we expect a slow but steady recovery in U.S. housing. Rent inflation and slightly rising mortgage rates may encourage more housing unit purchases. Healthy increases in house prices bode well for wealth perceptions and labor mobility, especially for the middle class. Moreover, we view the U.S. energy sector as one of the key drivers of economic and labor market growth. There is an ongoing shift in exploration of ‘tight’ and other ‘unconventional’ oil well formations. Hence, U.S. domestic oil production is higher than levels last seen in 1997. Lastly, increased oil production has benefited the U.S. trade deficit, whereby imports of crude oil are declining and exports of refined petroleum products are increasing. Given this encouraging energy sector backdrop, we continue to favor energy infrastructure exposures e.g. via MLPs and oil services.

In conclusion, the global growth outlook is still dependent on ongoing execution by both fiscal and monetary authorities. Risk assets, such as U.S. equities, have benefited from declining tail risks and a gradually improving global economy. From our investment lens, in a zero-rate environment, we see solid demand for income generating instruments such as MBS and large-cap dividend growing equities. At this stage of the business cycle, we remain tactically positioned in late-cycle and secular growth themes. From a bottoms-up valuation perspective, we seek favorable risk-reward opportunities that give us a margin of safety.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.