Credit stability and energy production can lead growth

Financial markets entered 2013 with an optimistic disposition on the back of a partial U.S. fiscal deal and on renewed optimism for global growth stabilization. In our view, tail risk reduction in Europe and its banking system is an encouraging factor for the world’s largest economic zone (EU area). We expect the ECB and other global central banks to continue their reflationary endeavors in an attempt to fend off the deflationary headwinds of debt deleveraging in developed markets. Moreover, we expect U.S. housing and the U.S. energy sector to be sources of growth in 2013. To be sure, we anticipate some fiscal headwinds to U.S. growth but fiscal visibility can be a positive catalyst for the U.S. corporate sector which has been holding back its capital and labor expenditures. From an investment perspective, we continue to be opportunistic in our capital allocation and we maintain our income/late-cycle positioning.

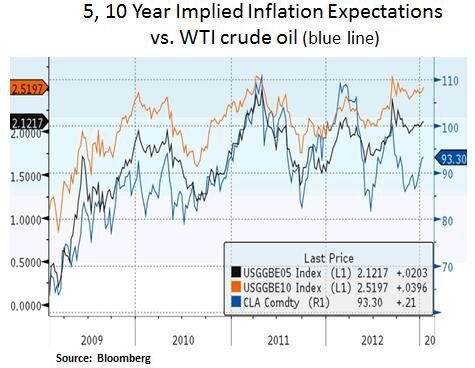

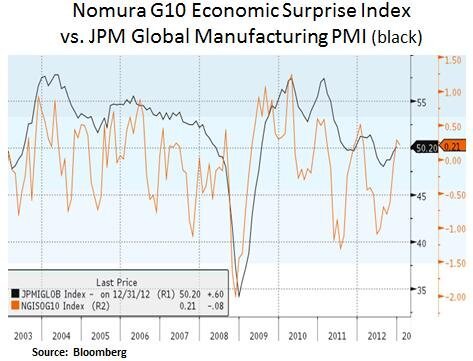

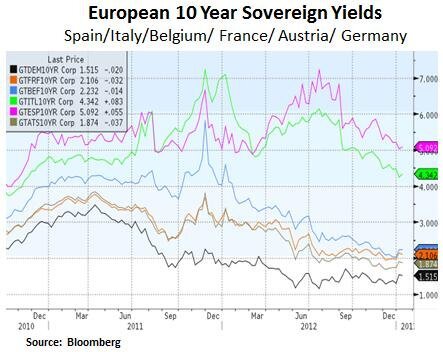

As we can see below, global manufacturing activity is showing signs of expansion (reading >50). Credit conditions in Europe continue to improve and at a minimum we see some prospects for stability in the European banking system. Expansion in the ECB’s money supply and deposit stability are encouraging developments. The European debt and growth crisis is not over by any means, as there is significant sovereign and private debt deleveraging to be implemented. However, from an investment perspective, we expect U.S. multinationals with exposure to Europe to benefit from a reduction in labor costs and from reduced local competition as smaller competitors are sidelined. Over the course of time, we also expect European unemployment rates to peak as credit conditions improve. Thus, we see scope for significant pent-up demand to be released and multinationals in the industrials and technology sectors in particular stand to benefit.

Stability in growth and credit conditions in Europe will likely stem the negative non-performing loan trend in peripheral Europe. Realistically, European banks in countries such as Spain will likely need further capital but in the meantime we expect the ECB to be more aggressive in 2013 in containing Spanish sovereign debt yields. In the face of challenging sovereign debt refinancing, Spanish politicians are likely to agree to the ECB’s active debt buying program (OMT). Therefore, credit stability in Europe can be beneficial to global growth and U.S. late-cycle global industrials such as GE, United Technologies (UTX) and Emerson Electric (EMR).

On the U.S. front, as we discussed in recent articles, we remain positive on U.S. housing and we look forward to further improvement in the health of the U.S. banking system. Corporate balance sheets have significant balance sheet capacity and commercial & industrial (C&I) loan growth remains positive. Therefore, even though corporate margins may have peaked in the last quarter, we see scope for higher returns on equity (ROE) via balance sheet leveraging. Moreover, healthy large-cap corporates have the capacity to increase their dividends. We highlight in particular the technology, healthcare and industrials sectors as potential sources of incremental capital allocations.

With regards to the U.S. consumer sector, we recognize the fiscal headwinds to disposable income on the back of the recent tax increases and payroll tax holiday expiration. We take some comfort though from the prospects in the U.S. energy sector. As a result of record domestic oil production we expect gasoline prices to soften even further. This will act an income relief to consumers. We remain bullish in the prospects for U.S. energy independence by the turn of the next decade. From a current account and jobs perspective, energy independence will likely alleviate future fiscal and demographic challenges.

Clearly, a resolution of the ongoing U.S. fiscal impasse is needed as a catalyst for business and household confidence. As we can see below, consumers’ future expectations have lagged recently and the corporate sector has been on hold with regards to capital spending. Realistically, we may see some near-term volatility during the upcoming debt ceiling/federal spending negotiations. Yet, it is likely that another deal will be achieved even at the 11th hour. Hence, looking into the second half of the year, there is scope for a recovery in household and corporate confidence as more fiscal visibility is achieved.

Lastly, from a thematic point of view, we favor exposures in the healthcare sector and we remain positive on the secular prospects for the emerging market consumer. Large-cap pharmaceuticals such as a Merck and Pfizer (MRK, PFE) and medical device makers such as Medtronic (MDT) stand to benefit from increased healthcare expenditures at the national and household level.

In conclusion, we continue to assess the macro and micro backdrop. We remain nimble in allocating capital as favorable risk-reward opportunities appear across the fixed income and equity spectrum. From a business cycle perspective, we seek exposures to late-cycle industries such as aerospace, healthcare and software. Lastly, we favor financial instruments with steady and growing cash flow profiles.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.