Central Bank Intervention Carries the Day

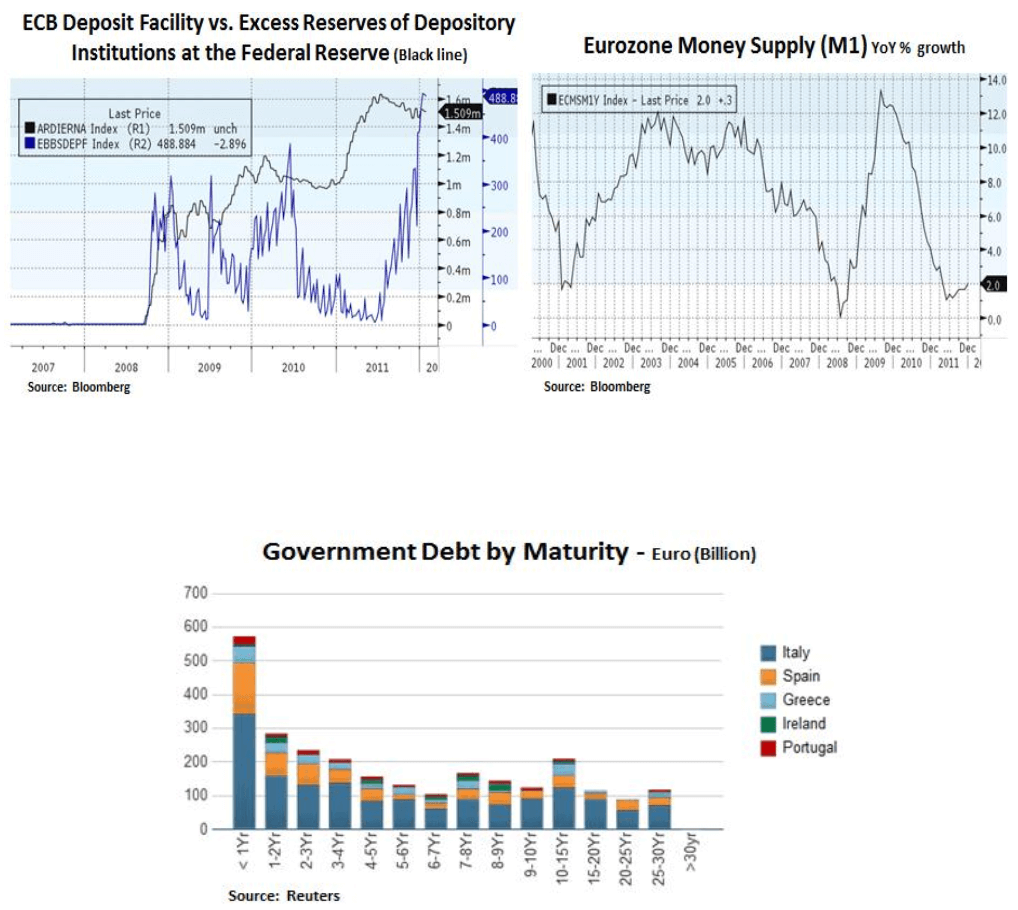

The ECB’s monetary accommodation is proving to be the most effective way to arrest the ongoing European sovereign debt and banking challenges. Funding costs have been eased for the critically important Spanish and Italian economies. Their future economic growth will determine the trajectory of borrowing costs but the ECB is at least succeeding in preventing a damaging systemic dislocation. With core European economies ring-fenced, Greek and Portuguese debt restructuring should be manageable if all affected parties reach a compromise. Therefore, although austerity measures and credit creation are big hurdles for Europe, the ECB is providing some breathing room in the long road for structural reforms and deleveraging across the Eurozone.

Stabilizing the banking system is a key step and as we mentioned in last week’s article policymakers should focus on growth policies and measures that will prevent a credit crunch in Europe e.g. by easing excessive capital requirements for banks. This is necessary as simultaneous fiscal and banking deleveraging will pressure growth and thus funding costs in a vicious circle. In addition, peripheral countries need to become more competitive and rebalance their current accounts with Germany, by lowering their own labor costs.

On the U.S. front, the U.S. Federal Reserve reiterated last week its accommodative stance by extending its low rate policy until late 2014 and established a 2% inflation target based on the personal consumption expenditure core price index. With the current price index below 2% the Fed chairman hinted at additional quantitative easing if growth and employment conditions render it necessary. From our perspective, extended investment flows in Treasuries and bond funds will likely seek new sources of yield e.g. in dividend paying utilities and telecom equities. Moreover, as far as the banking sector is concerned, a suppressed yield curve weighs on net interest margins. Yield curve expectations can only change if the U.S. growth and inflation outlook improves materially.

On the EUR/USD front, it is tempting to take a contrarian view on the Euro given the market’s short positioning. Fundamentally though, the European economy could still use a substantial devaluation of its currency and a more aggressive ECB can certainly achieve that, with further rate cuts and by further expanding its balance sheet. Therefore, although the Fed can engage in further quantitative easing itself, the immediate risk is for further Euro devaluation which could weigh on USD denominated assets e.g. in the materials sector.

On the U.S. growth front, Q4 2011 produced a 2.8% growth rate thus bringing 2011 growth to 1.7%. Although 2.8% is on the surface a good print, inventories contributed nearly 2% and could thus become a headwind in the coming quarters if the economy decelerates. On a more positive note, the ECRI leading economic index seems to be bottoming and the below January spread of New Orders/Inventories still hints to manufacturing expansion. Moreover, the Global Manufacturing index still indicates expansion, although stabilization in Europe will be a key driver in the near future as Europe faces growth headwinds. From our perspective, we maintain a preference for late-cycle industrials with long-product cycles and large order backlogs.

As we frequently discussed, employment growth is a key factor for the U.S. economy as consumer spending constitutes 71% of U.S. GDP. Our current expectation is for a small uptick for January’s unemployment rate and looking ahead it will be interesting to see how cash rich U.S. corporations will boost their labor forces in order to deal with decreasing productivity gains. This would be an important catalyst for the ongoing U.S. recovery and as we mentioned in last week’s article, a credible long-term fiscal policy will probably be needed in order to inspire business confidence. Without meaningful income growth, consumers will likely curtail their expenditures and will reinforce our valuation caution with regards to the consumer discretionary sector.

In conclusion, given the above backdrop of risks and opportunities, our investment positioning remains focused on a balanced mix of income generation and nimble selection of undervalued securities.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.