Markets Rethinking Inflation Expectations

August saw U.S. 10-year yields climb for a fourth straight month and the S&P 500 post its first monthly loss since February. On Friday, the government reported that the U.S. economy created 187,000 net new jobs last month, and while that beat consensus expectations of 170,000, it marks the third straight month of a sub-200,000 gain. Fed Chair Jerome Powell stuck to the “higher for longer” mantra on the Fed policy rate at the Jackson Hole meeting. He kept the possibility of further rate hikes alive and noted the strength of the economy while acknowledging declines in the pace of inflation.

Supercore inflation, which excludes the effects of housing, has become the Fed’s preferred measure of inflation, and remains sticky. While base effects have applied a meaningful downward influence on headline inflation for most of this year, that will soon be coming to an end. Moving forward, base effects seem likely to increase headline inflation figures over the coming quarters. This threat of rising headline inflation highlights the risk that policy will remain higher for longer.

The resurgence in energy markets also carries implications for both asset prices and broader economic health with its potential to disrupt inflation expectations. The Kingdom of Saudi Arabia announced yesterday that it will maintain its current 9 million barrel per day pace of oil production through the end of the year, keeping its output near multi-year lows. This came as a surprise to market observers who expected output to increase into year end. West Texas Intermediate crude rallied to 10-month highs in the wake of the announcement, while national gasoline prices topped $3.81 per gallon. Given energy’s impact on inflation and its correlation with inflation expectations, the Fed will be watching the situation closely as they shape monetary policy going forward.

The U.S. dollar is at its strongest in almost six months thanks in large part to higher yields in the U.S. and weaker-than-expected economic data coming from China and Europe. A strong dollar is punitive for assets in the rest of the world, and it is that weakness abroad, coupled with the resilience of the U.S. economy, that perpetuates that dollar strength.

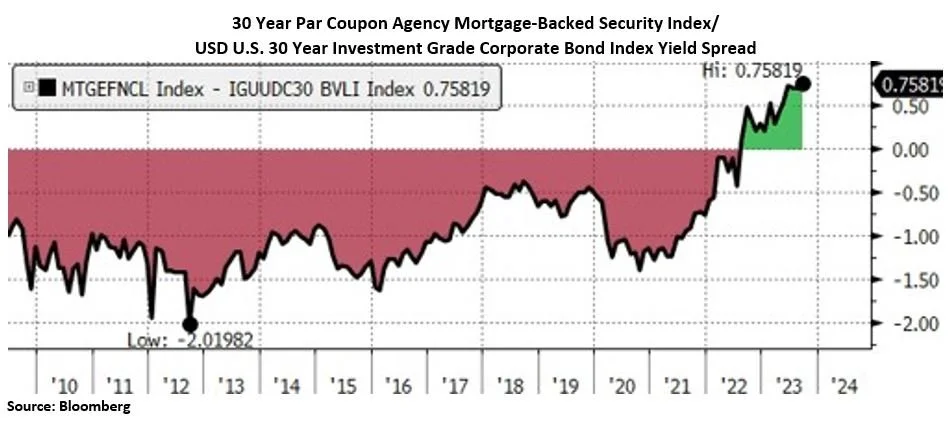

The rate-cut outlook keeps getting pushed further into the future as markets weigh stubborn inflationary components within the data. Thirty-year mortgage bonds offer the widest-ever spread over similar-maturity US corporate debt in at least 14 years, and we still view that as one of the most compelling asset classes in the current environment. The U.S. overnight reverse repurchase agreements fell to $1.568T, down from $2.553T at the end of last year as participants are increasingly convinced the Fed is done raising rates and are willing to buy and hold bills rather than parking cash on an overnight basis. At this juncture in the market cycle, we continue to prioritize high quality fixed income and select large cap equities.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.