Market attention likely to shift to the 2013 U.S. Fiscal and Growth Outlook

Financial market participants are currently focused on the prospects for a policy response to the ongoing debt crisis in Europe. In addition, the focus is on the global growth slowdown and how policymakers can respond via monetary and fiscal measures. In our view, as we approach the U.S. Presidential and Congressional elections, the market is likely to try handicapping the election outcome and how the currently projected fiscal drag (~4% of U.S. GDP) will be dealt with by year end. Thus far, the market has looked to the Federal Reserve for monetary support and at this stage, U.S. economic growth will likely depend on the 2013 U.S. fiscal outlook. Thus, the composition of the next U.S. administration will likely determine critical issues such as fiscal and budget sustainability, healthcare reform, financial sector regulation, energy policy, tax code reform and incentives for investments in capital and labor.

The U.S. economy has been benefiting from fundamental momentum in the U.S. energy sector, manufacturing and from supportive credit conditions. In addition, the corporate and household sectors are at an advanced stage in their balance sheet deleveraging. As we have discussed in recent articles, our short-term concern is whether businesses and households may postpone their investment and spending decisions due to uncertainty over fiscal policy. As we can see below, the ECRI leading economic indicator has softened as of late. Moreover, consumer confidence is showing some softening as well, presumably due to the recent rise in weekly jobless claims. According to the NFIB (National Federation of Independent Business) small business survey, public policy uncertainty is becoming a bigger issue than sales. Therefore, we continue to assess the impact of this uncertainty on the real economy and the consequent impact on the corporate earnings outlook.

To be sure, the U.S. economy is on a much better footing 3 years into its recovery. Mortgage costs have declined significantly due to the extraordinary response by the Federal Reserve. In addition, the U.S. banking system has recapitalized its balance sheet, corporations have reduced excess leverage and households have reduced their debt service burden via lower borrowing costs and mortgage defaults. Lastly, energy/gasoline costs are starting to subside due to increased domestic and international oil supply.

With regards to credit conditions, money supply is growing at a healthy yearly pace (9.5%) and funding costs are kept low due to the Federal Reserve’s easing policies. We expect monetary accommodation to continue, albeit with a diminishing impact on the economy as fiscal sustainability is becoming the main confidence and growth impediment.

The Federal Reserve is likely to maintain the size of its balance sheet at the conclusion of its current two day meeting. We do not expect any radical new measures as inflation expectations are within the Federal Reserve’s target range and as the Fed is likely to save whatever leeway it has left for any future economic deterioration. We also note that rent inflation has been rather sticky lately, which has been keeping the core consumer inflation index at an elevated level; as rent inflation accounts for 40% of core inflation.

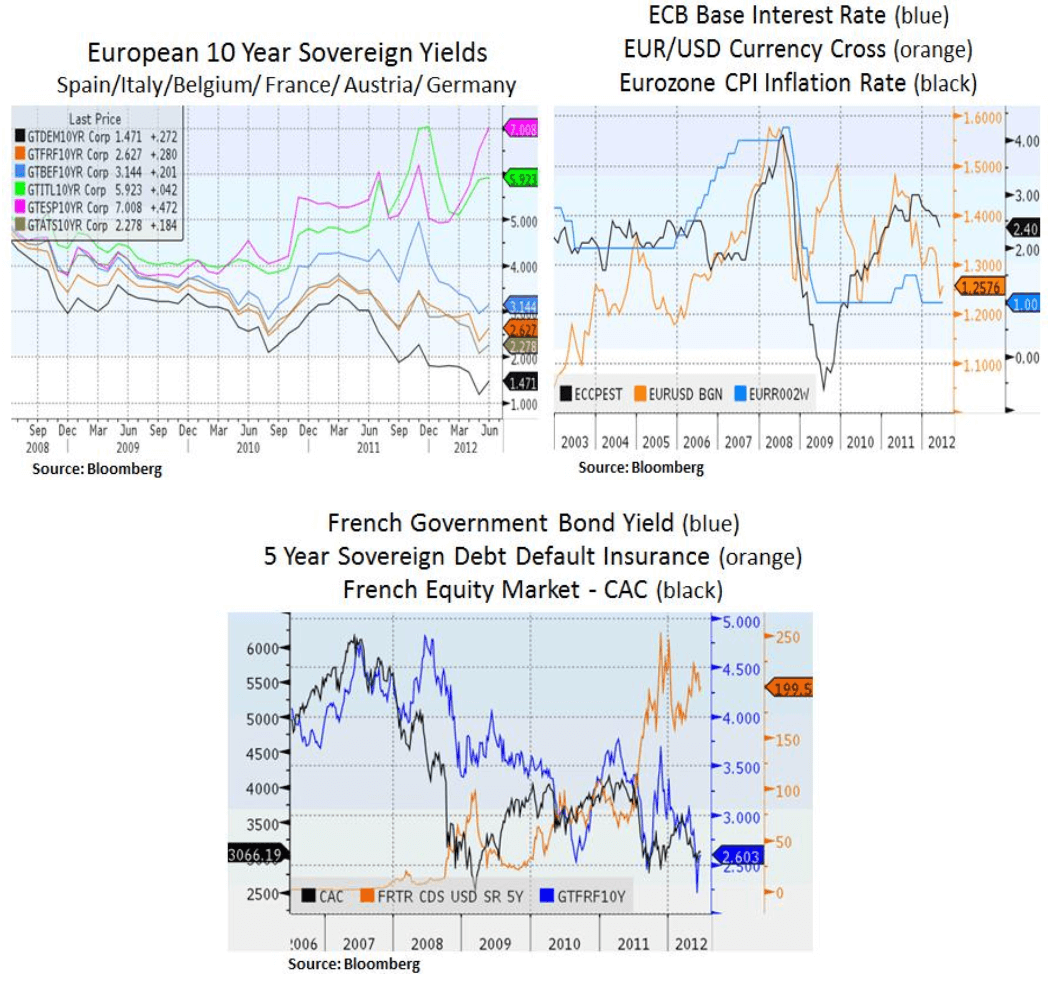

On the European front, elevated borrowing costs in Spain and Italy are likely to incite some additional policy measures in an attempt to stem systemic risk. At a minimum, it’s likely that a mechanism is put into place in order to keep borrowing costs in check, perhaps via ECB bridging liquidity until a more permament debt restructuring facility is agreed upon. Moreover, as German growth prospects are coming under pressure, we anticipate more rate cuts by the ECB. As credit contagion is spreading to the larger European economies, we expect political leaders to be more willing for compromises and burden sharing. We caution though that political divisions will likely cause some further volatility until sustainable solutions are put into place.

On a more positive note, as global inflation pressures ease and as systemic risks are gradually controlled, we see scope for global growth to resume. We are more constructive on the emerging market growth outlook as secular fundamental underpinnings are still in place. To be sure, emerging market growth is still influenced by developed market demand but we expect developing economies to gradually be driven by domestic demand, especially as labor forces and middle classes expand. Therefore, U.S. multinationals e.g. in the energy, tech and industrials sectors are likely to enjoy healthy earnings growth.

As we can see below, we note that earnings expectations and economic surprises have declined as of late. It is likely that visibility over the 2013 U.S. growth outlook in particular will be a critical factor to the reversal of these expectations and overall risk sentiment. Short-term volatility or market fear indications have declined in the past week but we note that the VIX futures curve still indicates some uncertainty by year end.

In conclusion, given the above risk-reward profile we are tactically positioned in securities that offer more visible earnings and cash flows. In a zero-rate environment and with an elevated desire for income, we expect defensive sectors to remain in demand e.g. telecoms, consumer staples, healthcare and utilities. Lastly, we continue to harvest steady yields from mortgage backed securities (MBS) and select preferred shares.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.