Increasing expectations for global fiscal activism

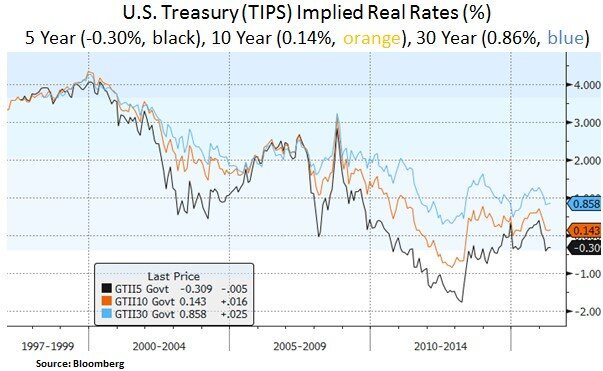

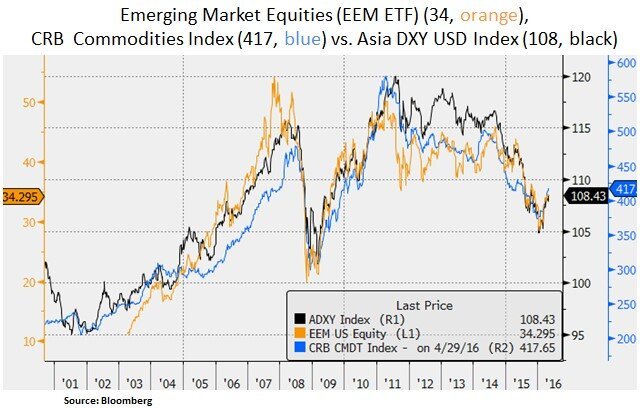

Financial markets have witnessed in the past two months a reflationary wave on the back of recovering Chinese growth data, a softening U.S. dollar and a recovery in oil/commodity prices. Expectations for a relatively dovish Federal Reserve have kept real interest rates in check. U.S. equities have continued to outperform their developed market peers i.e. S&P 500 +1.45%, MSCI Europe -6.8%, Nikkei -14.6% (year-to-date). Sovereign bond yields continue to remain relatively subdued i.e. 10 Year U.S. Treasury Yield at 1.8%, German 10 Year Bund yield at 0.20% and the Japanese 10 Year JGB at -0.13%. Corporate credit spreads have continued to recover (i.e. tighter spreads). A softer dollar is alleviating some of the earnings headwind U.S. corporations suffered in 2015 e.g. for international U.S. pharmaceuticals, capital goods and technology companies. From our portfolio perspective, we continue to favor a steady source of income from e.g. non-agency MBS, preferred shares and selective positioning in large-cap U.S. equities that offer a good mix of value and cash flow resiliency.

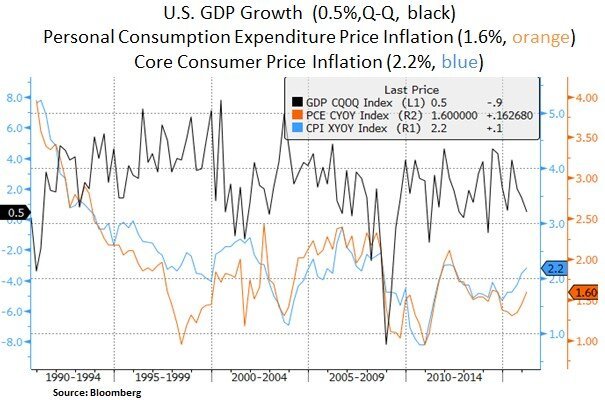

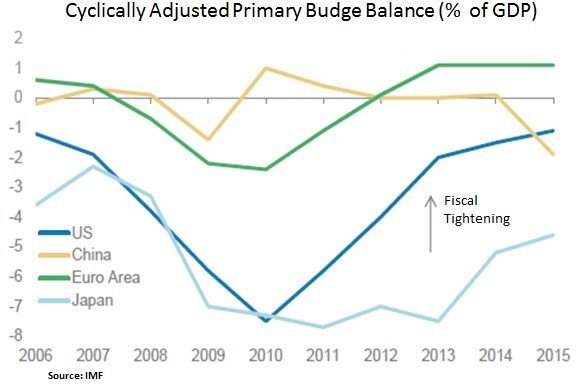

After an extended global monetary policy cycle, investors are now looking to potential fiscal policy measures as a means to create a direct source of global demand. As discussed in past articles, there are diminishing returns to Central Bank action due to underlying demand for credit. Even though U.S. non-financial corporations have been releveraging, U.S. consumers have been in deleveraging mode (i.e. balance sheet repair since the 2008 crisis). In the U.S., core inflation metrics have recently been firming up; in contrast to U.S. GDP growth (+0.5% in Q1 2016). U.S. fiscal policy has been tightening since 2010. On the global front, European and Japanese fiscal policies have a neutral and tightening bias respectively. China has recently begun to run higher budget deficits i.e. by doubling its deficit in the past 12 months (to 3.8% of GDP). Even though sovereign debt levels remain elevated, subdued sovereign bond yields open up a window of opportunity for more expansionary fiscal policies. Such a scenario would be a source of support for the global profit cycle and U.S. multinationals (e.g. industrials, energy and technology).

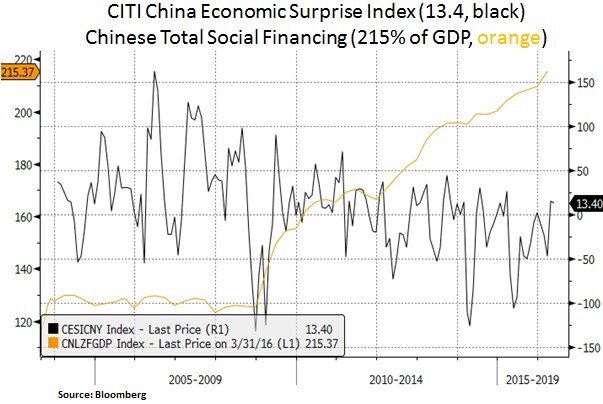

On the Chinese growth front, investors have been greeting incoming data with mixed feelings. On the one hand there is a sense of relief with regard to the medium–term GDP growth/inflation outlook; and China’s contribution to global economic growth. On the other hand, there is some skepticism with regard to the longevity and sustainability of the recent ‘mini-cycle’ in Chinese infrastructure and property markets. The main reason for this skepticism is the ongoing reliance on credit expansion. There is also a concern that China is reverting back to ‘old school’ means of generating growth i.e. investment spending (vs. a shift to consumer led growth). China matters especially for global demand for oil and commodity prices. At this juncture, we are leaning on mega-cap energy leaders that have strong balance sheets and improving free cash flow profiles; which in return support attractive dividend yields. As indicated in the most recent earnings season, companies such as Exxon, Chevron and BP continue to pare back their capital expenditures as they navigate the current energy down cycle.

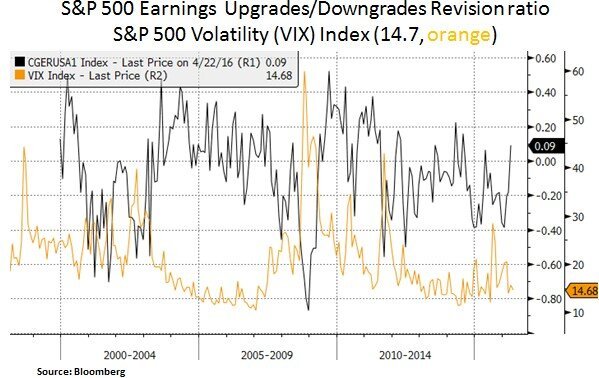

Lastly, with regard to the U.S. earnings cycle, we note that the last couple of quarters are increasingly been viewed as an interim trough; as energy/USD related headwinds abate. As we can see below, the S&P 500 earnings revision ratio has continued to recover i.e. the ratio of analyst EPS upgrades vs. downgrades. Moreover, a softer U.S. dollar and an improved earnings profile have contributed to a reduction in U.S. equity volatility. We note however that after a 14% rally since an intra-day low of 1810 (Feb 8th) on the S&P 500, U.S. equities seem fairly valued and hence we remain nimble and selectively positioned. Healthcare remains a preferred sector as it offers secular growth dynamics (drug pipeline growth/demographically driven demand) and sustainable dividend growth. In the current earnings season for Q1 2016 results, healthcare stood out as a sector that surprised on the upside in terms of earnings/revenue guidance.

In conclusion, we continue to strive for an attractive mix of income generation and total return opportunities. We are keen to see whether proactive global fiscal action will complement monetary policies or whether it will remain a back-up policy option.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.