Fed’s Shift to Neutral Policy to Dictate Degree of USD Strength

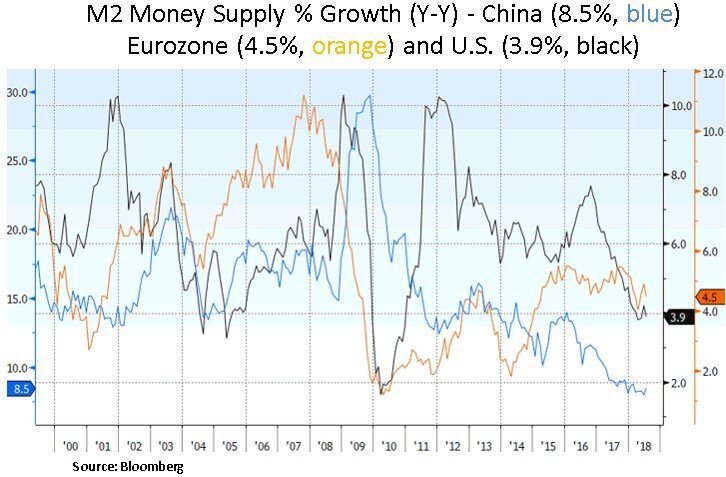

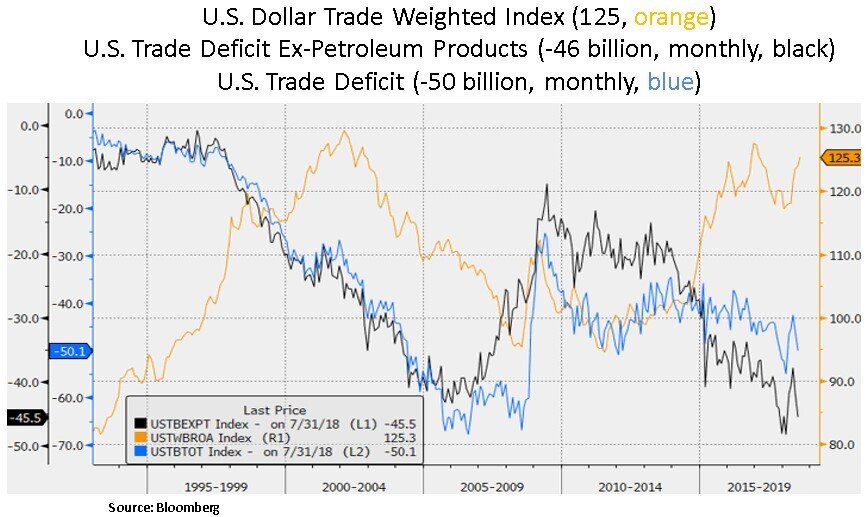

Financial markets are currently navigating a backdrop that features elevated emerging market (EM) currency volatility and an acceleration in EM capital outflows. The Fed’s ongoing monetary tightening and the fiscal reform induced repatriation of offshore USD (Eurodollars) are causing the current global shortage of USD funding. This is prompting some defensive increase in EM FX reserves and interest rate hikes by EM Central Banks to defend their currencies and thus stem inflation pressures. Dollar-denominated debt in 21 major emerging-market economies has surged to about $6.4 trillion from $2.8 trillion in 2008. Vulnerable countries that have large external USD denominated debt and twin deficits (budget and current account) have seen large currency declines year to date e.g. Argentine peso (-52% vs. the USD) and Turkish lira (-42%). Global equity markets have also diverged i.e. S&P 500 +9.5% (total return YTD), MSCI Europe +0.17%, MSCI Emerging Markets -8.3% and Shanghai A (-14.8%). Moreover, ongoing trade protectionism between U.S. and China has triggered weakness in the Chinese yuan (-4.7% YTD). Further U.S. tariffs on Chinese goods may exacerbate the Chinese currency weakness - unless the rumored upcoming tariffs on $200bn of Chinese exports is simply a negotiating tactic. We note that while global liquidity and financial conditions are tightening, the PBOC is currently easing as it attempts to shield Chinese growth.

Ahead of another highly probable Fed hike on 26th Sept., the impact of dollar tightening on EM currencies is unlikely to abate. Further out though, and into 2019, the Fed tightening outlook may become more ambiguous and could eventually provide some relief to EM economies. It is likely that the Fed’s balance sheet reduction process may also end much earlier than expected. If the Fed were to open the doors to skipping some quarterly hikes, this would also be a major positive for global liquidity and EM financial conditions.

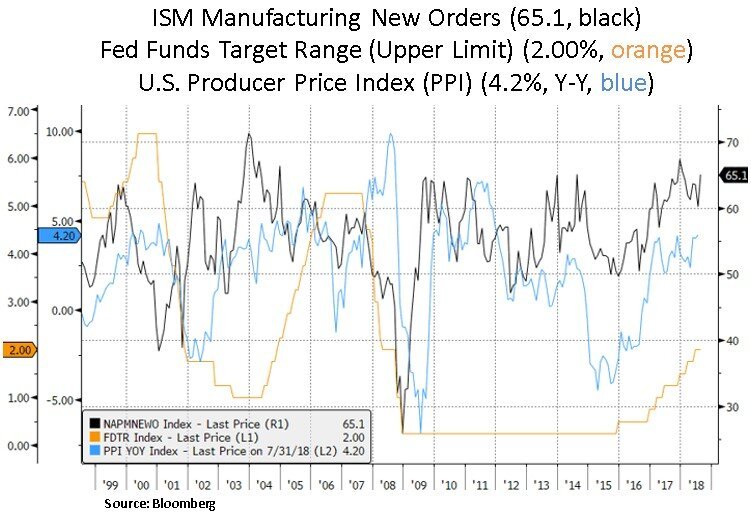

The shape of the U.S. Treasury yield curve continues to be a topic of investor debate as it has continued to flatten. In our view, a flattening of the curve should indicate, at a minimum, a loss of economic momentum over the next 12-18 months. From a U.S. domestic point of view, the broad spectrum of economic data remains supportive. The latest ISM manufacturing report has indicated a pick-up in new orders and labor demand, but we also note an increase in inventories, which may be a front loading of goods; as trade tensions may disrupt global supply chains. From a cyclical point of view, the U.S. labor market continues to tighten and in fact labor markets are tightening in all the main global regions; and global unemployment is near the lowest levels in 30 years. Even in the Eurozone there has been a sharp increase in labor shortages recently, which could be a prelude to a rebound in wages. As long as growth, inflation and asset prices remain firm, the Fed still has the green light to raise rates and thus dry powder ahead of the next downturn.

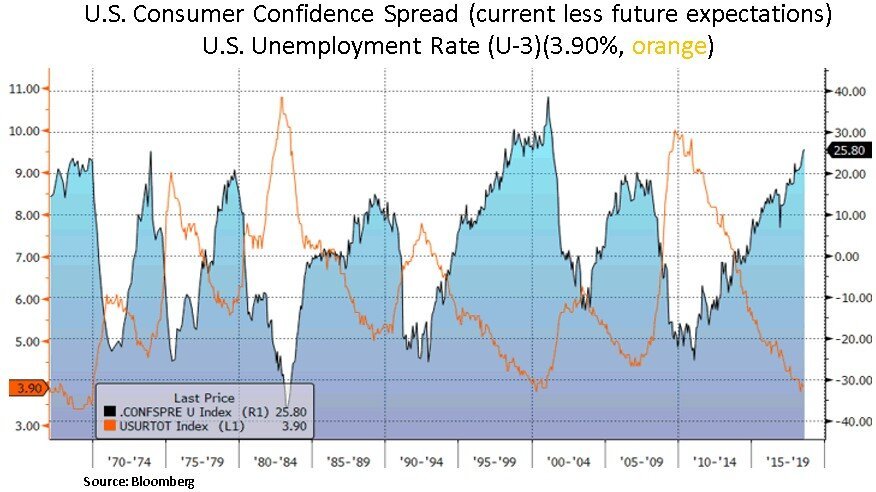

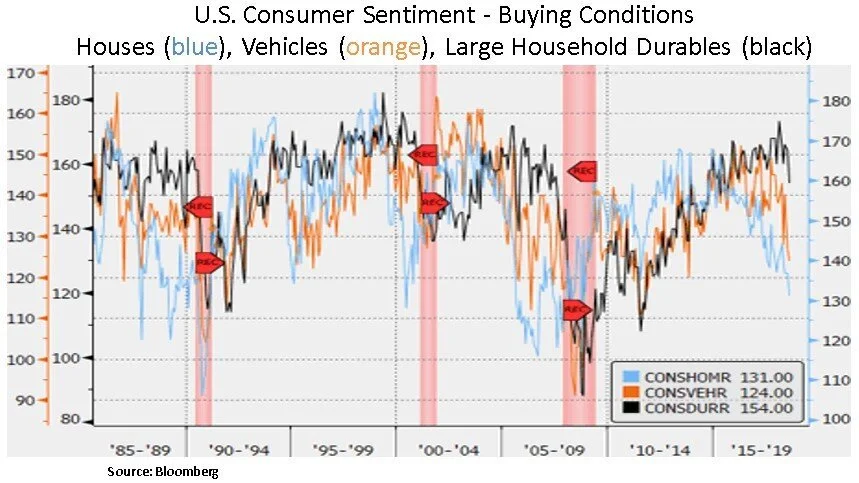

However, the bond market is expecting only 3 more rate hikes by the end of 2019 vs. the Fed’s expectation of 5 hikes. With the current 2-10 spread of 0.24%, the yield curve is likely signaling that the Fed has already approached ‘neutral’ territory and further hikes would risk an inversion of the curve and a more material tightening of credit conditions. Currently, corporate credit spreads are still tight, but they have started to widen from their lows. On the consumer front, current measures remain robust but future expectations have started to diverge. Hence the spread of current-future confidence expectations has exceeded the prior cycle high. We also note that buying intentions for large item purchases are indicating some caution. Therefore, we tend to agree with the market’s view of fewer rate hikes vs. the Fed’s own expectations. As such, we continue to advocate long-term exposure to income generating instruments; particularly as we see strong secular demand from a retiring Baby Boomer generation.

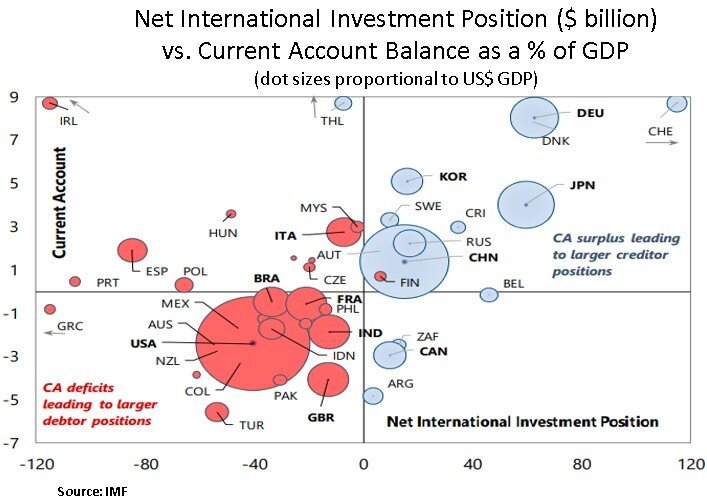

Lastly, we highlight below the outlook for the U.S. budget deficit. With a high sovereign debt load, the U.S. international net asset position is likely to continue to deteriorate. Most likely, foreign investors will need additional compensation to be incentivized to deploy capital in the U.S.; a weaker USD or higher yields would likely be necessary. Chances are the Fed will attempt to keep yields in a ‘neutral’ zone. Thus, as the budget deficit expands the Fed will likely have to pare back some of its tightening expectations. Even though in the near-term USD strength is a headwind for U.S. multinationals, we expect the dollar to face challenges over the long-term. As such, U.S. corporations in the technology, healthcare and energy sectors are likely to be beneficiaries of a weaker USD.

In conclusion, we are currently seeing elevated emerging market currency volatility amidst a decline in global liquidity and cross-border flows. Moreover, a stronger 2018 U.S. growth backdrop and record share buybacks have led to a divergence between the U.S. and other global equities. Strong portfolio flows into the U.S. have also added fuel to USD strength. The flattening Treasury yield curve however, continues to signal interest rate path uncertainty. Particularly, as we move past the fiscally induced sugar rush in 2018 U.S. growth. As the U.S. budget deficit expands and the business cycle continues to mature, we expect the Fed’s stance to move to a more neutral stance. As such, we see long-term challenges for the USD. From our perspective, we look to take advantage of any policy mistakes that may give rise to both equity and bond market volatility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.