Elements of Fundamental Stability Likely to Face Headwinds

Happy New Year. As we enter 2012 market participants are taking some comfort from signs of stability in the global manufacturing sector and from fairly positive leading indications in the U.S. labor market. Recent declines in market volatility, in a low volume trading setting, may prove to be transitory though as developed market economies face the twin headwinds of fiscal consolidation and banking deleveraging in Europe. In addition, geopolitical risk in the Middle-East cannot be ignored as Western nations are now embarking on a series of financial embargo measures against Iran. Therefore, although we are open-minded with regards to a latent improvement in the U.S. economic recovery, we are also realistic with regards to the run-off of fiscal stimulus measures in 2012 and the ongoing economic and credit challenges in Europe. Thus, we maintain a cautious portfolio posturing and we seek to take advantage of value opportunities that episodes of volatility will likely create.

As we can see below, recent coincident manufacturing data are pointing to some fundamental stability and the spread of U.S. New Orders to Inventories is not indicating an immediate recessionary pullback in manufacturing. Having said that, we note that the ECRI leading indicator currently indicates tepid growth ahead and as noted in our last article investment tax credits are running off to a large degree in 2012. Moreover, the broader economic surprise index shows signs of peaking.

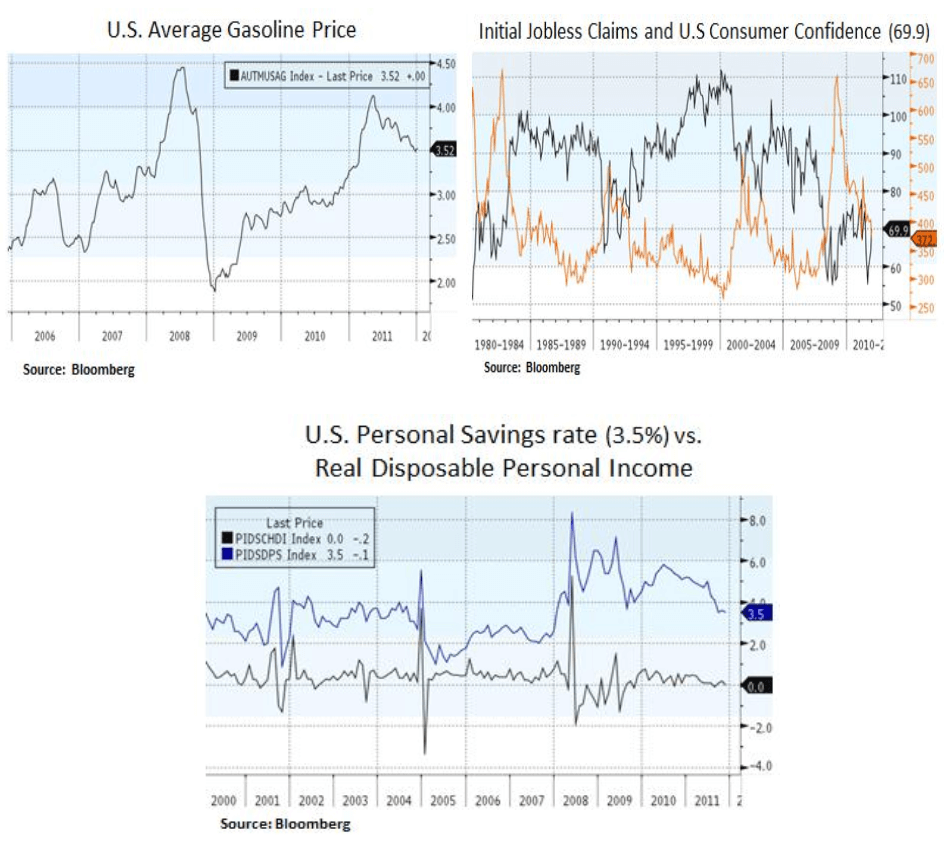

On the U.S. consumer front (71% of U.S. GDP), we note a recent rise in consumer confidence and an improvement in the U.S. labor market leading indicator i.e. initial jobless claims. On the more cautious side, we note that consumer spending benefited in 2011 from declines in gasoline prices and a decline in the personal savings rate. These two elements may not be sustained in 2012. In addition, although improvements in the overall employment picture are welcomed, we are skeptical with regards to the actual job mix and its subsequent impact on income growth. In other words, income lost from job losses in higher paying sectors (e.g. government, financial sector) may not be offset from income gained in lower paying sectors. Thus, consumer spending in its totality may show tepid future growth.

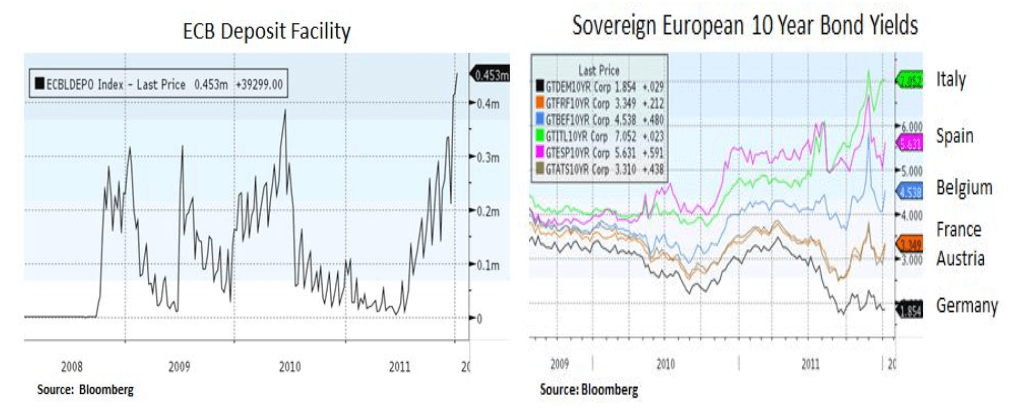

On the other side of the pond, in the past few weeks the ECB has facilitated an easing in banking liquidity pressures by offering substantial 3 year loans to financial institutions. However, the recent surge in the ECB’s deposit facility indicates that there is reluctance for interbank lending and thus credit creation. Moreover, new liquidity from the ECB has not improved the long-term sovereign funding and solvency outlook for Europe’s core economies. As economic growth deteriorates in Europe we expect the sovereign debt market to face increasing headwinds, especially in the context of a demanding refinancing schedule in 2012.

On a more positive note, easing European inflation will likely allow some room for further ECB monetary accommodation which may cushion to a certain degree fiscal consolidation pressures on economic growth. Consequently, one can only hope that a European recession will not be severe. Credit market stability will be a decisive factor in the above conjecture and will determine the course of future volatility and risk aversion episodes.

In conclusion, we enter 2012 with a cautionary stance and we seek to take more risk when the right risk-reward conditions are in place. Thus, in our core asset allocation we lean towards income generation from financial instruments that offer cash flow and earnings visibility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.