Easing inflation and systemic solutions can be pivotal to market sentiment

Financial markets continue to assess the outlook for global growth and for a sustainable solution that will stem European systemic risks. Ultimately, the European economic system needs to be placed on a viable path whereby excess debt is restructured. In addition, structural reforms need to be expedited in order to promote growth, competitiveness and economic cohesion. As cyclical and systemic risks rise, it is plausible that a grand compromise is reached by Germany - the main creditor in the Eurozone. At the global level, easing inflation pressures are allowing more scope for further monetary easing that will cushion the current cyclical slowdown. Tactically we remain cautious on risk assets with a preference for income yielding instruments and we remain alert for favorable risk-reward opportunities that episodes of volatility may create.

As we can see below, economic data in developed economies (G10) has been disappointing. In addition, despite a proposed EU 100bn bank bailout for Spanish banks, sovereign borrowing costs in Spain and Italy have been rising. Even the credit default swap spread for insuring German government debt has been rising as a result of contagion fears. In our view, if push comes to shove, a grand compromise has to be reached. Germany exports twice as much to southern Europe than to China and as the biggest creditor nation within the Eurozone it has a lot at stake. One plan that is currently gaining traction with German opposition parties is the creation of a European Redemption Fund. This fund will basically pool debt in excess of 60% of debt/GDP and extend the maturity profile of the jointly guaranteed debt to more than 25 years. Such a mechanism is probably a pragmatic compromise by Germany who has been opposing the creation of Eurobonds. This mechanism may also appease national governments that oppose a full fiscal and political union; that would entail the surrender of national sovereignty.

On the global monetary front, we see an opportunity for policymakers to be more aggressive with their policies as energy and food inflation eases. In Europe, the ECB has more room to cut interest rates from the current 1% base rate and thus improve southern Europe’s competitive advantage. In China, the PBOC cut rates last week for the first time since 2008 and with inflation easing to 3% we see more scope for further monetary accommodation. As China is one of the world’s largest oil consumers, the Chinese equity market seems to be pointing to a lower oil price, as a result of China’s economic slowdown. Therefore, easing crude prices are key to the cushioning of global growth. Given their secular fundamental underpinnings, we expect emerging markets to gradually resume their growth trajectory. This will be beneficial to U.S. multi-national companies.

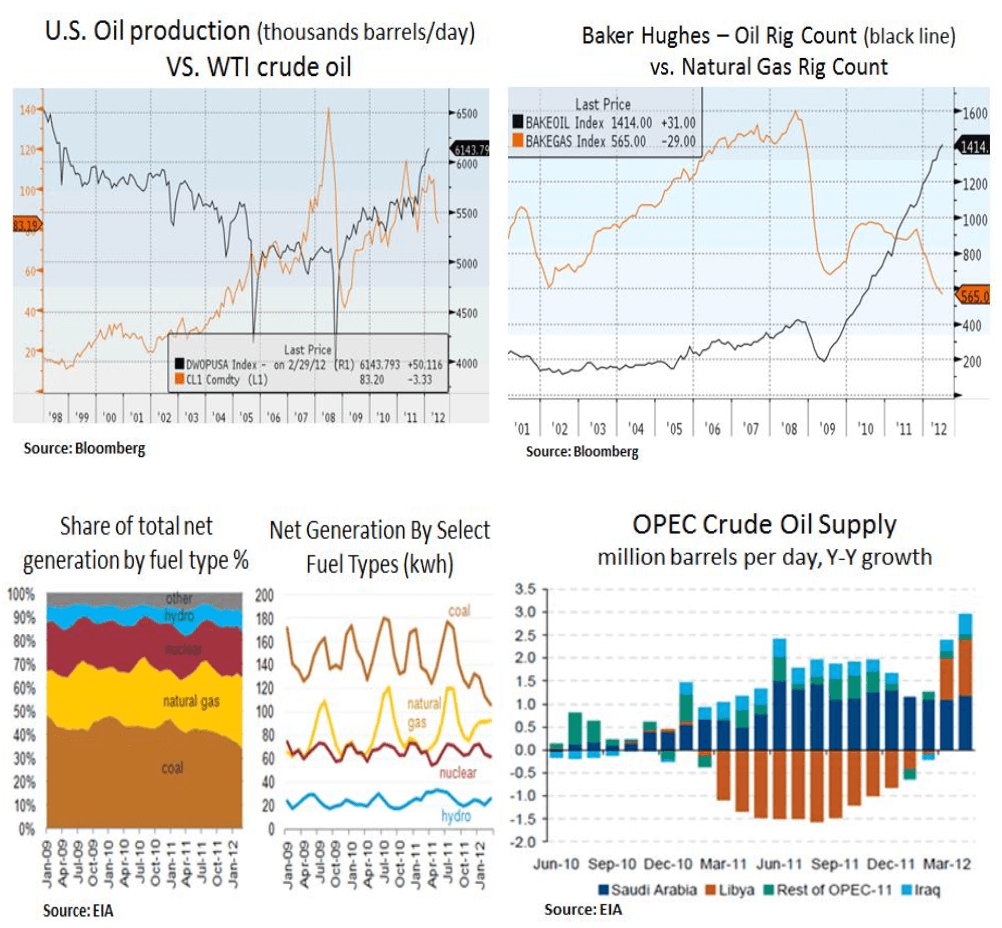

From a big picture perspective, technological advancement in horizontal drilling is assisting the global economy in lowering its energy costs. This is especially evident in the U.S. whereby the energy renaissance continues in the unconventional well space. Consumers are already benefiting from low electricity prices as natural gas prices have fallen as a result of a supply surge. From an environmental point of view, low natural gas prices have also led to a reduction in the use of coal as a source of fuel for power generators. Moreover, low natural gas prices are also benefiting the chemical sector as it is a key input cost.

U.S. oil production is rising to levels last seen in 1998. This is important for the U.S. trade deficit as oil imports account for 60% of the deficit. Therefore, at a time of elevated fiscal pressures, the U.S. energy sector can be a key contributor to the country’s competitive advantage. Lastly, on the global front, we note that the OPEC crude supply has recently recovered due to a return of Libyan and Iraqi oil supplies. This alleviates concerns with regards to a tightening of OPEC spare capacity and thus allows Brent crude oil prices to ease.

Current indications point to a moderately growing U.S. economy, as shown by the ISM manufacturing new orders and the level of 5 year inflation expectations i.e. inflation and growth expectations are steady. A mid-cycle slowdown cannot be precluded at this stage of the economic recovery and we remain focused on the 2013 fiscal outlook. In addition, we are assessing the potential outcome for the U.S. presidential and congressional elections which are likely to have a meaningful impact on business and consumer confidence. A potential lifting of the political gridlock in Congress would be beneficial with regards to achieving a sustainable fiscal path. Lastly, we remain positive on the outlook for U.S. housing which is boding well for the health of U.S. bank balance sheets and middle-class household wealth.

In terms of tactical sector positioning, we are leaning by and large on defensive sectors such as telecoms, utilities, consumer staples and healthcare that offer earnings visibility and healthy dividend payouts. Within technology and industrials we are positioned in late-cycle areas such as software and commercial aerospace. Lastly, we are currently avoiding more cyclically leveraged sectors such as materials and consumer discretionary.

In conclusion, we continue to favor a balanced portfolio with a tilt towards income generation and we retain our nimbleness to take advantage of favorable risk-reward opportunities as market expectations and equity correlation wane.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.