Dis-inflationary pressures bode well for further global policy easing

Investors continue to navigate their way in an environment of challenged economic growth, fiscal uncertainty and political volatility in a period of transition in Europe, the U.S. and China. Despite many hurdles, we believe the major economic zones are on their way to economic rebalancing and to more sustainable economic profiles. In the medium term, disinflationary pressures will enable global central banks, particularly in Emerging Markets, to ease their monetary policies even further and thus put into place the conditions for the next global cyclical leg. Tactically our portfolio positioning remains cautious and we look to increase our risk exposure at favorable risk-reward entry points.

In Europe, easing crude oil prices and declining labor costs in the periphery will likely enable the ECB to take an even more aggressive role in monetary easing with further interest rate cuts. Currency devaluation across the Eurozone will improve current account competitiveness; especially in southern Europe which is lagging on the export side. Price stability is the ECB’s single policy mandate and Mario Draghi will likely seek to stop deflationary pressures from undermining corporate profitability. As we can see below, the sovereign bond markets in Europe have started to discount lower growth and deflation fears. Thus, we expect a more active ECB role.

On the European credit side, we note that following the ECB’s EU 1.3 trillion refinancing programs credit conditions have started to ease and as the ECB is back-stopping the European banking system, we expect demand for credit to gradually recover. To be sure, the deleveraging process in Europe is likely to lead to a low growth environment but as long as economic actors don’t deleverage at the same time, the deleveraging process does not need to lead to systemic pressures. As shown in past deleveraging episodes e.g. in Sweden, the public sector should not tighten into a recession and should allow corporations and households to rebuild their balance sheets first. As we can see below, households and corporations have positive savings rates. They just need confidence in order to increase their expenditures, which will contribute to lower sovereign deficits over time.

In China, we expect easing oil/commodity prices to enable the PBOC to ease monetary conditions as inflation remains in check. As we can see below, typically the Chinese stock market leads oil prices. A quiet period on the Iranian turmoil due to the U.S. election and lower global demand will likely lead to lower crude prices. Thus, we expect crude to ease to more tolerable levels i.e. $80-95 range. Last week, the Saudi oil minister reiterated S.Arabia’s goal to ease oil prices below $100. Therefore, Chinese monetary authorities may get an opportunity to stimulate growth by cutting reserve requirements in the banking system. We also note that stability is the guiding principle during Chinese political transitions. Thus, in the face of weak European growth (20% of China’s exports) we expect China to be more active on monetary policy. Lastly, other major EM economies such as Brazil are likely to re-accelerate as inflation becomes less of a concern.

In the U.S., we note that credit conditions are steadily improving. U.S. banks are extending more credit, particularly in the Commercial and Industrial loan space (20% of U.S. bank loans). On the demand side, it appears that conditions are equally healthy. This bodes well for overall economic growth, especially as small/medium sized businesses account for nearly 50% of employment growth.

With regards to employment, we note that the April jobs report was disappointing but deceleration was expected as demand for labor was brought forward during a very warm winter. As we can see below, the most recent manufacturing and small business surveys show positive employment trends. On the manufacturing front, we note that growth conditions appear encouraging; most likely driven by strong traction in the energy sector.

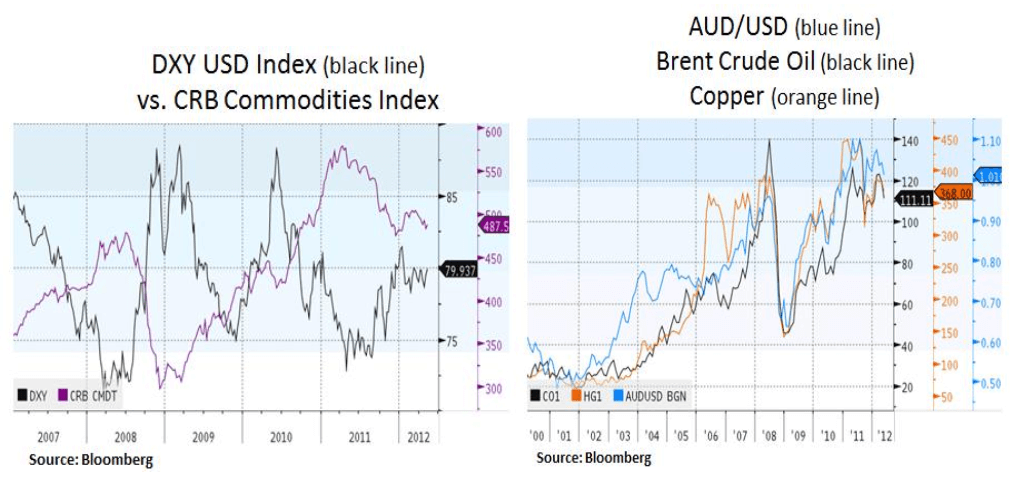

After a strong performance of risk assets, we remain tactically cautious and as we highlighted in recent articles we expect fiscal 2013 uncertainty in the U.S. to create some headwinds due to policy vacuum. We also note that short-term leading indicators such as AUD/USD, crude, commodities and copper appear under pressure.

In conclusion, we maintain our cautious and income oriented portfolio structure. On the equity side, we have shifted some of our cyclical exposure into more defensive sectors that offer healthy dividend growth and earnings visibility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.