Declining Inflation Expectations Prompted Fed Policy Shift

Investors witnessed a marked decline in equity and interest rate volatility in January. This was primarily due to the Fed’s policy shift to a more patient normalization stance and away from the expectation for a gradual pace of rate increases. The Fed also signaled more flexibility in terms of adjusting the size and composition of its balance sheet if conditions render necessary. The Treasury market saw marginal steepening in the long-end of the curve and real interest rates declined. Moreover, inflation expectations rebounded, and corporate credit spreads tightened. For U.S. equities, the total return year to date is as follows: S&P 500 +9%, Dow Jones +8.8% and Nasdaq +11.2%. Fixed income benchmarks such as the Barclays U.S. Aggregate Bond Index (AGG ETF) and Markit iBoxx USD Liquid Investment Grade Index (LQD ETF) saw 0.7% and 3.4% total return for the month respectively. We also note expectations for a U.S.-China trade deal added to the market’s anticipation of a Goldilocks backdrop (i.e. monetary stability with good enough growth). In addition, the recent earnings season generally yielded more benign corporate outlooks, although management commentary was generally focused on weaker growth in Europe and China.

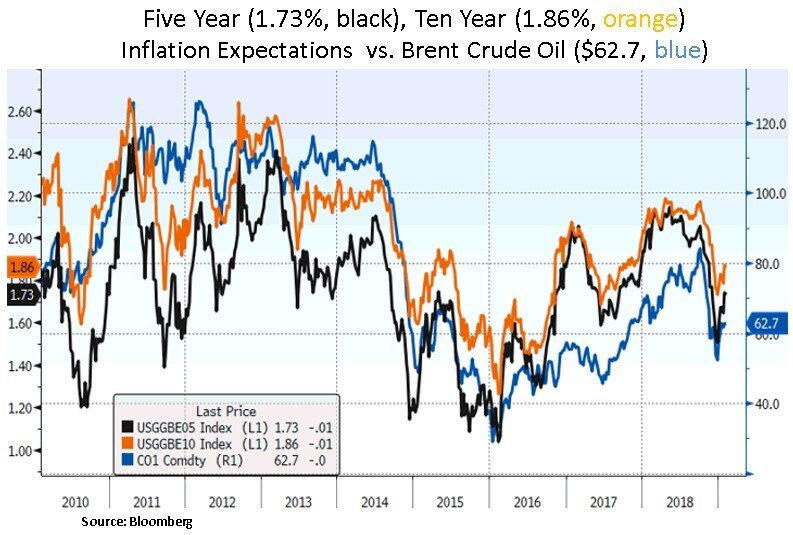

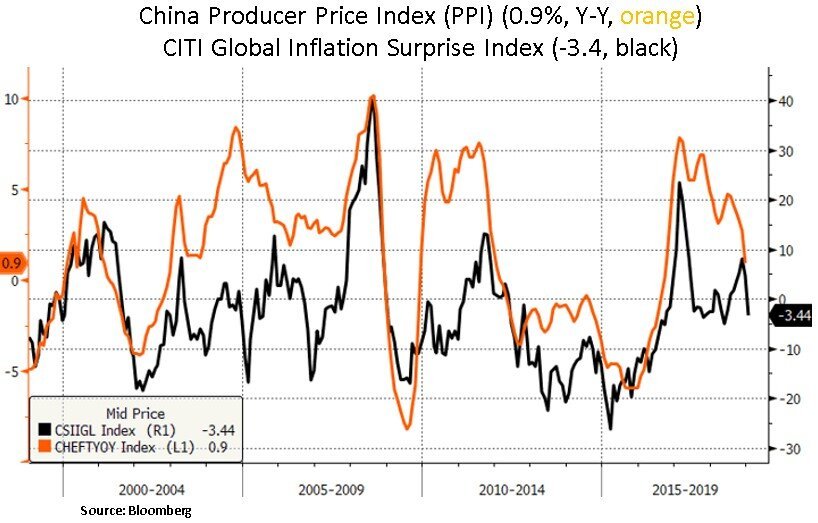

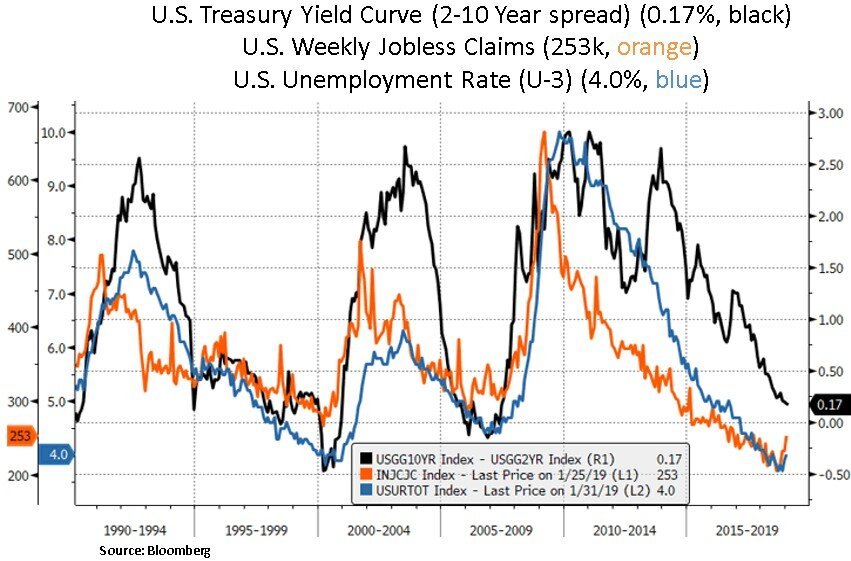

From our lens, the Fed responded to the drop in inflation expectations and a broader tightening of global financial conditions. International growth and disinflationary concerns likely contributed to the Fed’s shift to a patient stance. As we can see below, several inflation metrics likely validate the Fed’s reaction. Leading indicators such as the shape of the Treasury yield curve, widening corporate credit spreads and the equity market likely forced the Fed’s hand.

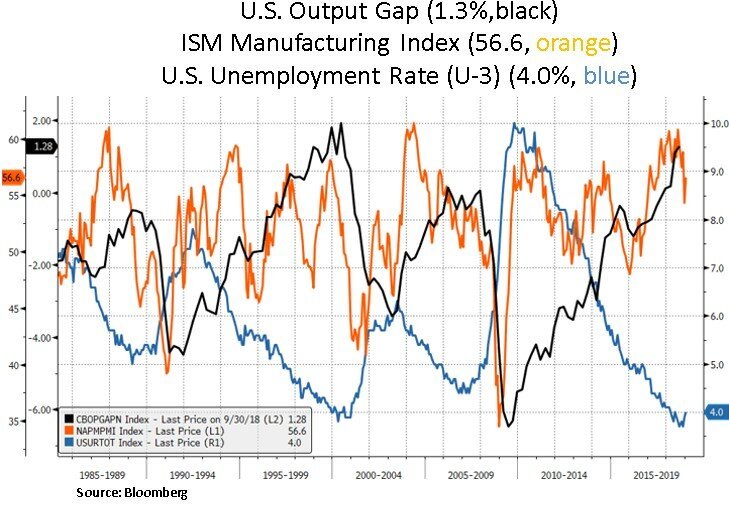

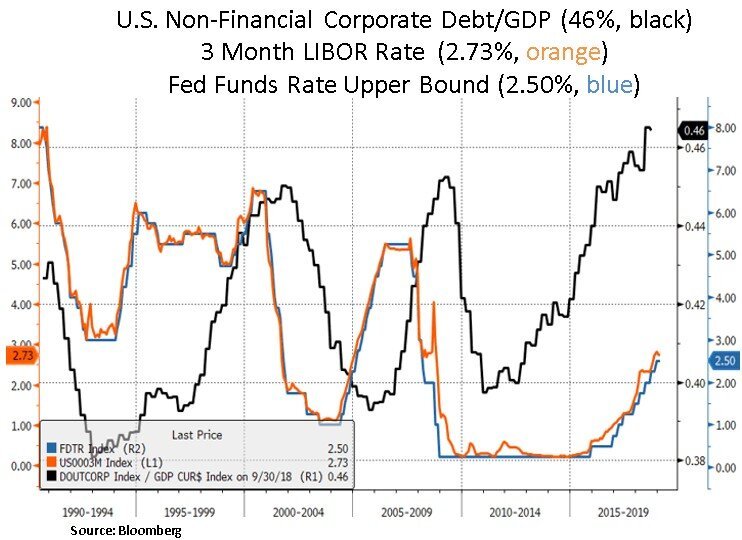

To be sure, the Fed’s policy shift reduced the probability for a prospective policy error i.e. over-tightening with repercussions for financial conditions and U.S. growth, particularly as the current business and credit cycles are fairly mature. Questions remain regarding what is a sustainable pace of growth in major economies such as Europe and China after several years of monetary intervention (Europe) and a gargantuan credit expansion (China). From a U.S. perspective, the U.S. labor market remains firm with increasing labor participation. We note however that future consumer confidence expectations have started to lag current conditions. On the banking side, the most recent January Senior Loan Officer Survey indicated that banks expect to tighten standards for all categories of business loans as well as credit-card loans and jumbo mortgages. Banks also anticipate that loan performance will deteriorate for all surveyed categories and banks are increasingly saying they are seeing weaker demand for mortgages and consumer loans.

From our perspective, credit leads growth and growth leads inflation. As we can see below, the current U.S. output gap already surpassed its break-even level and a positive output gap is not sustainable historically. Economic growth and inflation may have already reached their potential and no inflation overheating is currently observed. Therefore, the Fed’s pause may last for a little while. Eurodollars futures are pricing an interest rate cut from the Fed as more likely than a hike this year as early as December.

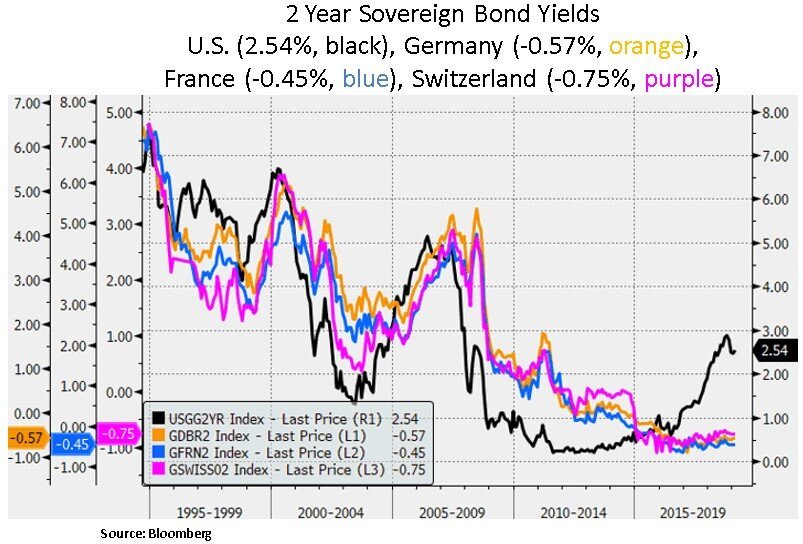

Lastly, we note that with the recent growth deceleration in Europe, sovereign yields remain depressed; and at the front end of the curve especially, yields remain in negative territory. Despite our concerns for widening U.S. deficits, we suspect that global yields may act as an anchor for U.S. yields as the yield spread remains significant. Regarding the U.S. yield curve, we note that the front end of the curve remains flattish. The 2-10 spread is flat on a month to month basis at 0.17%. We suspect that the shape of curve is still signaling some cautiousness regarding future growth and inflation.

In conclusion, from our portfolio perspective, we continue to focus on quality balance sheets, sustainable earnings growth stories and income generation. At the sector level, we continue to like secular growth opportunities in technology, communication services, healthcare and selective large cap defensive names across all sectors. From a bottom-up perspective, we focus on free cash flow growth and credit quality. As consensus profit and margin expectations remain elevated for 2019-2021, we will likely have several stock picking opportunities throughout the year and as each earnings season unfolds.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.