Credible long-term policies are needed

Financial markets continue to assess the global economic growth outlook for 2013 and beyond. Since the recession of 2008-2009, the U.S. economic recovery has been supported by substantial fiscal and monetary accommodation. At this stage in the business cycle it is critical for households and businesses to gain visibility on the next round of policy measures that will deal with structural hurdles such as entitlement spending and fiscal sustainability. The market’s current focus is on the impact of the scheduled 2013 tax increases and federal spending cuts. Beyond any near-term piecemeal resolution of the ‘fiscal cliff’, businesses are also likely to focus on whether the U.S. economy can move into a sustainable expansion or whether it will stay in the current lackluster growth trajectory. For a sustainable expansion, businesses need to deploy their healthy balance sheets and create the necessary job growth that will subsequently generate much needed household income growth. From our investment lens, we maintain our income/late-cycle portfolio positioning and we seek to find favorable risk-reward opportunities in fixed income instruments and equities.

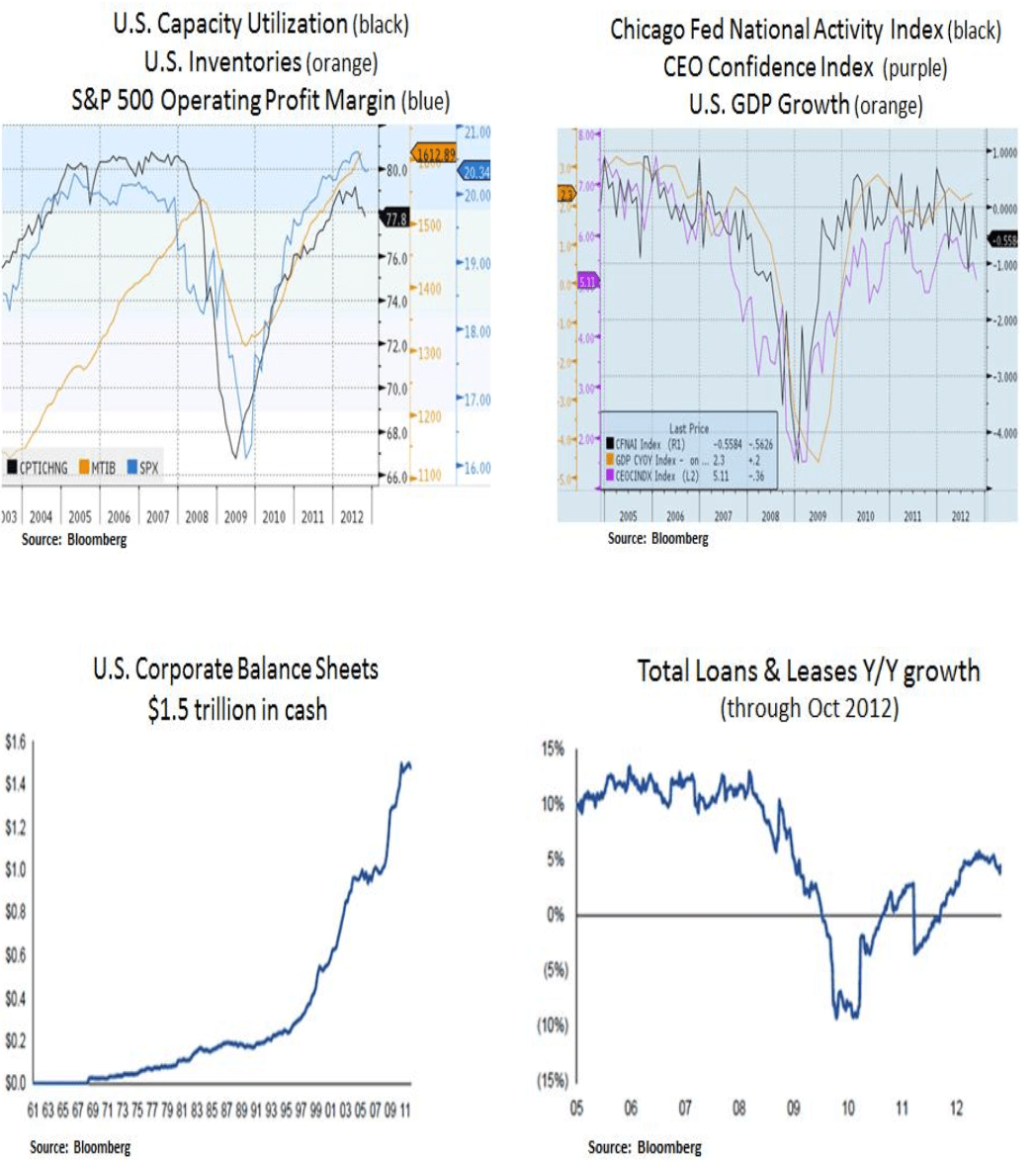

After a significant recovery in profits and business activity since 2009, earnings growth is now by and large dependent on revenue growth; which in turn is linked to U.S. domestic and global economic GDP growth. Historically, profit margins have been mean-reverting and in the recent cycle businesses have benefited from reduced interest rates, lower effective tax rates and subdued labor costs. As long as the economy keeps expanding, peak profit margins do not necessarily imply peak absolute profits. As we can see below, in the recent quarters CEO confidence has been lacking and major capital expenditure plans have been on hold due to the election and fiscal uncertainties. Yet, corporate balance sheets and loan growth remain healthy. Along with a recovering housing market, we remain optimistic that credit conditions and a credible fiscal plan can be constructive for capital spending in 2013. We continue to favor late-cycle industrials with secular growth e.g. in commercial aerospace and power generation infrastructure.

Apart from the immediate cyclical outlook, we also focus on some of the chronic issues that the U.S. economy has been facing. For example, there has been a noteworthy divergence between corporate profitability and labor wage growth. Median household incomes have been on the decline and the income gap has been widening according to levels of education i.e. college educated workers are enjoying a low unemployment rate (3.8%). At the demographic level, workers older than 55 years of age have been extending their employment tenures; albeit at lower salaries. We remain cautious on the U.S. consumer due to weak real income growth. Thus, we have a preference for emerging market consumer spending themes, whereby labor incomes are growing and household balance sheets are un-levered.

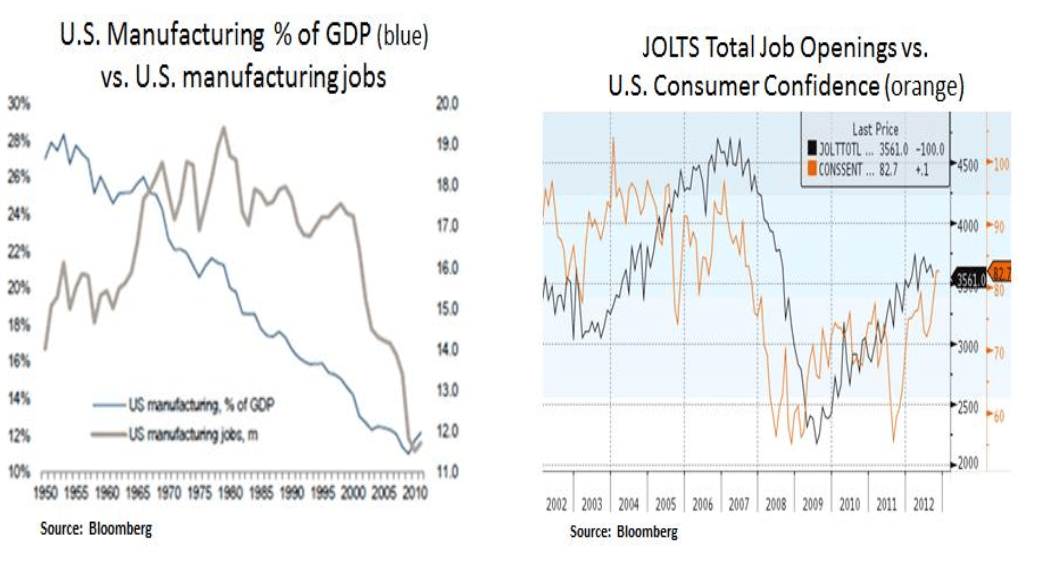

The tech and housing bubbles in the past decade (along with easy monetary policy) have been masking persistent challenges such as the decline of U.S. manufacturing and the changing demand for skilled labor. Our expectation is for U.S. manufacturing to see a gradual renaissance due to lower domestic energy costs and as high value products require a workforce with more advanced skills. Along with improved consumer confidence, businesses have been opening up more job vacancies but it appears that there is a severe skills mismatch. Apart from improving the U.S. education system, one of the solutions is to radically overhaul the U.S. immigration system. Countries such as Canada and Australia have been very successful in attracting foreign labor with the necessary skills to fill labor shortages. Two thirds of Canada’s immigration visas are employer sponsored. In the U.S. however, the bulk of the immigration visas are family sponsored and there is a cap on the number of working visas. Unfortunately, Congress has been distracted by illegal immigration issues. Thus, a credible long-term immigration policy is needed that will deal with both legal and illegal immigration in order to attract high quality labor and ambitious entrepreneurs.

Demographics and entitlement spending is also a precarious issue for CEOs and households. More than 75% of the federal spending is non-discretionary. As the Baby Boomer generation (1946-1964) is starting to retire, fiscal sustainability is becoming more challenging. Steps have to be taken to arrest the cost of spiraling healthcare outlays (Medicare/Medicaid) e.g. 5% of patients account for 50% of healthcare spending. Economic growth and a complementary immigration policy are key ingredients to improve the U.S. demographic outlook. In past decades, female labor force participation was a key driver of the labor force’s expansion. Therefore, a holistic policy change needs to take place in order to increase the size of the labor force. From our investment perspective, we prefer exposure to pharmaceuticals that will likely benefit from increased medication use as demographics change. On the other hand, we remain cautious on domestic consumer spending as older generations need to increase their savings. Moreover, due to demographics and zero interest rates, we expect escalating demand for income sources from both fixed income instruments and dividend growing equities.

Turning to Europe, we expect 2013 to be the year whereby the ECB becomes more aggressive in its sovereign debt purchases; especially for Spanish debt. This would be beneficial for stability in the credit system and a further reduction in risk-aversion. In addition, one would also expect at least one or two ECB interest rate cuts in an attempt to make the Euro more competitive against the USD. This would help European growth, which is more leveraged operationally to global growth. Subdued inflation in emerging markets will likely spur EM central banks to be more aggressive with their monetary policies; thus Europe would be a prime beneficiary from a global growth recovery. The current ratio of central bank assets for the ECB and the Federal Reserve would imply a lower EUR/USD currency cross. On the other hand, a comparison of the total central bank assets vs. their domestic GDP would indicate that the Fed could expand its balance sheet even further; leading to USD weakness, which is possible given the current ‘unlimited’ quantitative easing policy. From an interest rate differential though, downside risks to the EUR/USD keep us cautious with regards to USD sensitive sectors such as materials.

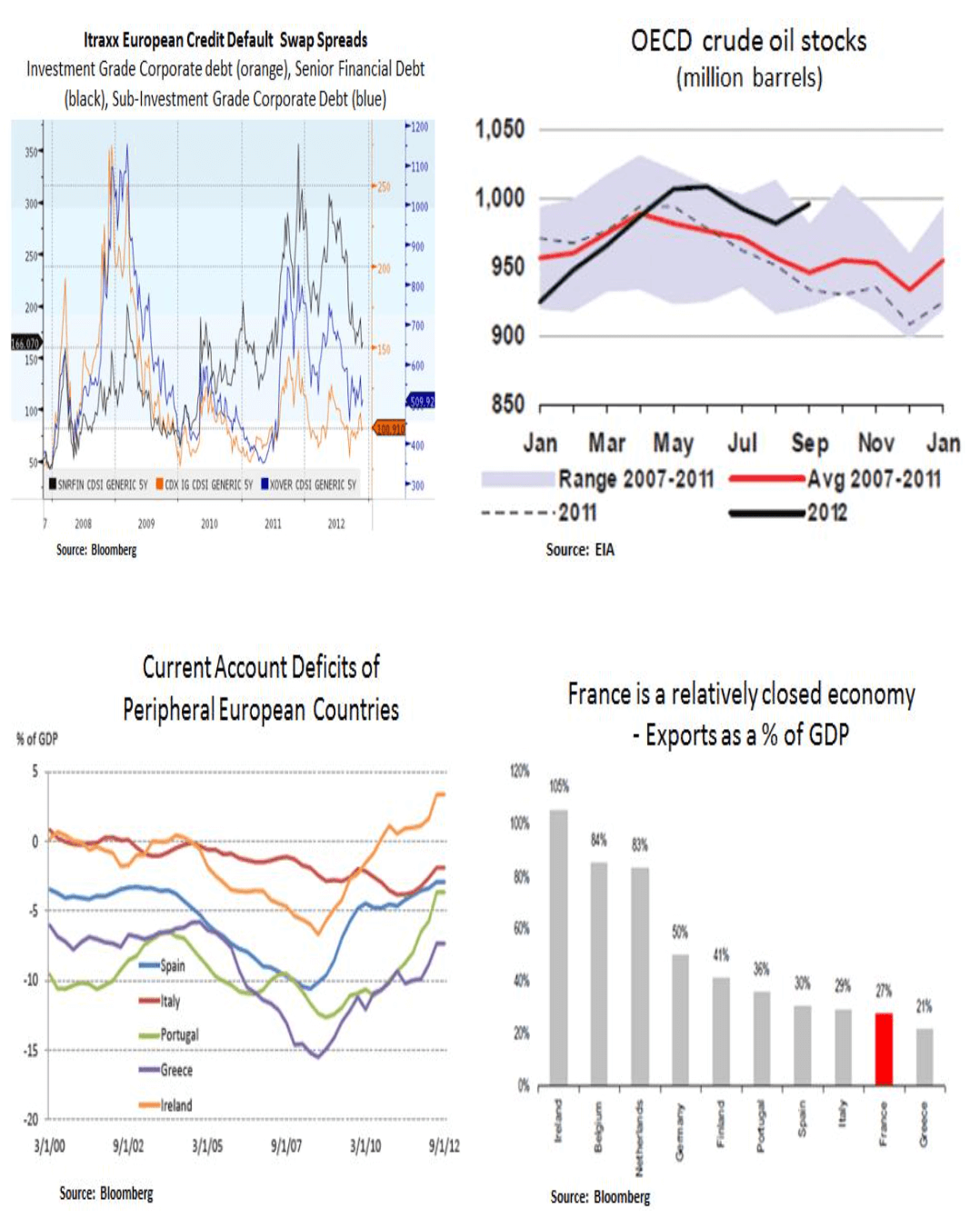

On a more positive note, we are encouraged by the relative calm in the European corporate credit market as highlighted below by the decline in credit default swap spreads. To be sure, the European banking system is still over-leveraged and it still needs additional capital e.g. in Spain as non-performing loans keep rising. At a minimum though, we expect the ECB to contain systemic risk and over time allow for the banking system to heal as overall deleveraging runs its course. We also highlight the improvement in the current accounts of peripheral European economies. The decline is by and large explained by declining imports due to weak domestic demand. As we can see below, developed economies are well supplied in crude oil, with inventories running above recent average levels. A decline in brent crude prices will likely give further support to their current account balances. Perhaps the biggest risk for the peripheral European economies is a lack of pro-active measures and extensive regulatory overhaul, in an effort to improve their competitiveness. Political divisions and social unrest could cause further volatility episodes in the Eurozone until economic divergences are ironed out over time. Transitioning from unsustainable to sustainable economic policies is not likely to be a painless process. Even ‘core’ countries such as France are over-spending on government expenditures (55% of GDP) and the country is lagging in terms of export driven growth opportunities. With a newly elected socialist president, a lack of pro-business measures is putting the sustainability of low sovereign borrowing costs at risk. Thus, we continue to assess the European growth outlook and its likely impact on U.S. multinationals.

In conclusion, 2013 is likely to be another year where policy decisions will be critical to the global growth outlook. We expect global central banks to continue their easy monetary support as fiscal constraints in the developed economies weigh on growth. From a bottom-up perspective, we continue to seek favorable risk-reward opportunities across the fixed income and equity spectrum. Lastly, we favor instruments with visible cash flow metrics and equities with secular growth outlooks.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.